2024 Retirement Plan Contribution Limits

This post was last updated on 31 December, 2024, to reflect all updated information and best serve your needs.

Planning for your retirement is the key to fully enjoying the fruits of your labor. Whether you have an IRA (individual retirement account), a 401(k) or other retirement account, you'll want to get the most out of it by maximizing your contributions. Understanding the contribution limits put in place by the IRS will help you maximize your savings.

Since most retirement accounts are tax-advantaged, meaning that they are subject to special taxation rules. They are a great way to secure your income. The tax advantages are great for people saving for retirement, but the IRS has enforced contribution limits - they still need to generate tax revenue.

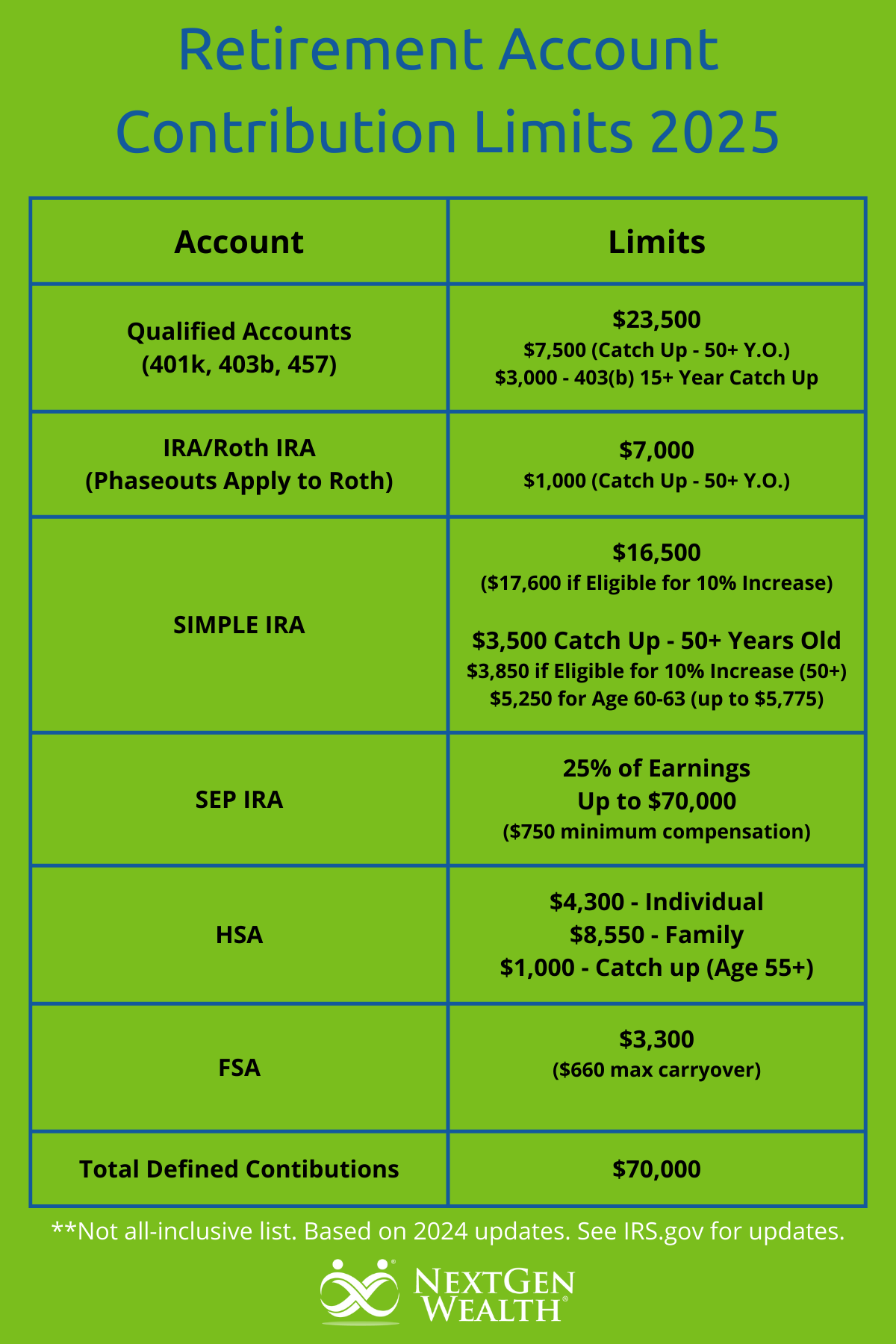

Every year the IRS updates contribution limits to account for inflation. Staying up to date with all information regarding retirement accounts can be the difference between pinching pennies and living large. Let’s take a look at various retirement plan contributions limits for 2025.

401(k) Contribution Limits

401(k)s are one of the most common retirement accounts for employees today. Defined contribution plans have nearly replaced the standard, defined benefit pensions that once dominated retirement plans. They are made up of investments such as stocks and bonds. Typically, a 401(k) is not taxed on its earnings until withdrawn during retirement. Roth 401(k) accounts, on the other hand, typically offer tax-free withdrawals.

In 2025, the amount an employee can contribute to their 401(k) will increase to $23,500. The “catch up” contributions, for those 50 and over, is still $7,500. The total contribution limit from employers and employees combined will be $70,000.

For those over 50 years old, the total contribution limit could be a total of $77,500 due to the addition of the $7,500 catch up amount.

Since many 401(k) contributions are made through direct salary deductions, it is important to speak with your employer regarding your contribution amount. While it is crucial to save for your retirement, you never want to sacrifice your well-being today. A financial advisor can help determine how much you can afford to save.

Individual Retirement Accounts (IRA)

Just like 401(K)s, IRAs are usually made up of a variety of investments including stocks and bonds, as well as other valuable assets. IRAs are what are called tax-advantaged accounts.

In 2025, the contribution limit for traditional and Roth IRAs remains at $7,000. The catch-up amount is also the same at $1,000 for those age 50 years and older. That brings the total to $8,000 for savers 50 and up.

Having different retirement savings plans will go a long way toward securing your golden years. Check out this article for more information regarding the different ways to save for retirement.

SIMPLE IRA

For small business owners and self employed, a SIMPLE IRA has a lot of benefits. Like a 401(k), employers contribute to their employee’s SIMPLE IRA as does the employee. The IRS changed the contribution limit to $16,500 (or $17,600 with the 10% increase depending on income). The catch-up amount is $3,500 for age 50+ or $5,250 for age 60-63. There may be an additional 10% increase as well depending on your income so the catch-up could be as much as $3,850 (age 50+) or $5,250 (age 60, 61, 62, or 63).

When using a SIMPLE IRA, employers are not permitted to offer any other type of retirement account. If you are a small business owner, discuss the benefits of each retirement account with a financial advisor in order to figure out which one would work best for your business and your employees.

Employees who are offered a SIMPLE IRA retirement plan should discuss with their employer how much of their salary they wish to contribute to the retirement plan. A financial advisor can also help employees make a financially sound decision regarding this investment.

Finding the Right Retirement Plan for You

The increased contribution limits for 2025 should be a major help for you to maximize tax-deferred retirement savings. If you are a business owner of any size, figuring out which retirement plan offers the highest degree of benefit to your employees is a nice perk.

Take the new contribution limits into account and share them with your employees. They'll want to know the changes so that they can use their judgment on how to best prepare for retirement.

Discuss the limit adjustments with a financial advisor and figure out how the changes could affect your business. You do not want to lose out on retirement savings, so staying up to date will allow you to best prepare for your future.

When it comes time to enter your retirement, take care to discuss the transition with your financial advisor so that it does not overwhelm you. Click here to learn more about ways to transition into retirement.

We Can Help

Whatever your financial situation, experience, or knowledge, NextGen Wealth is here to help. We have helped many clients make sense of their financial situation and prepare for a brighter future.

If you have any questions, give us a call at 816-287-4780 or contact us here. Understanding your financial security doesn’t have to be confusing. We have the expertise to help you out wherever you are on your journey.