Everything You Should Know About an Emergency Fund

This post was last updated on December 31, 2022, to reflect all updated information and best serve your needs.

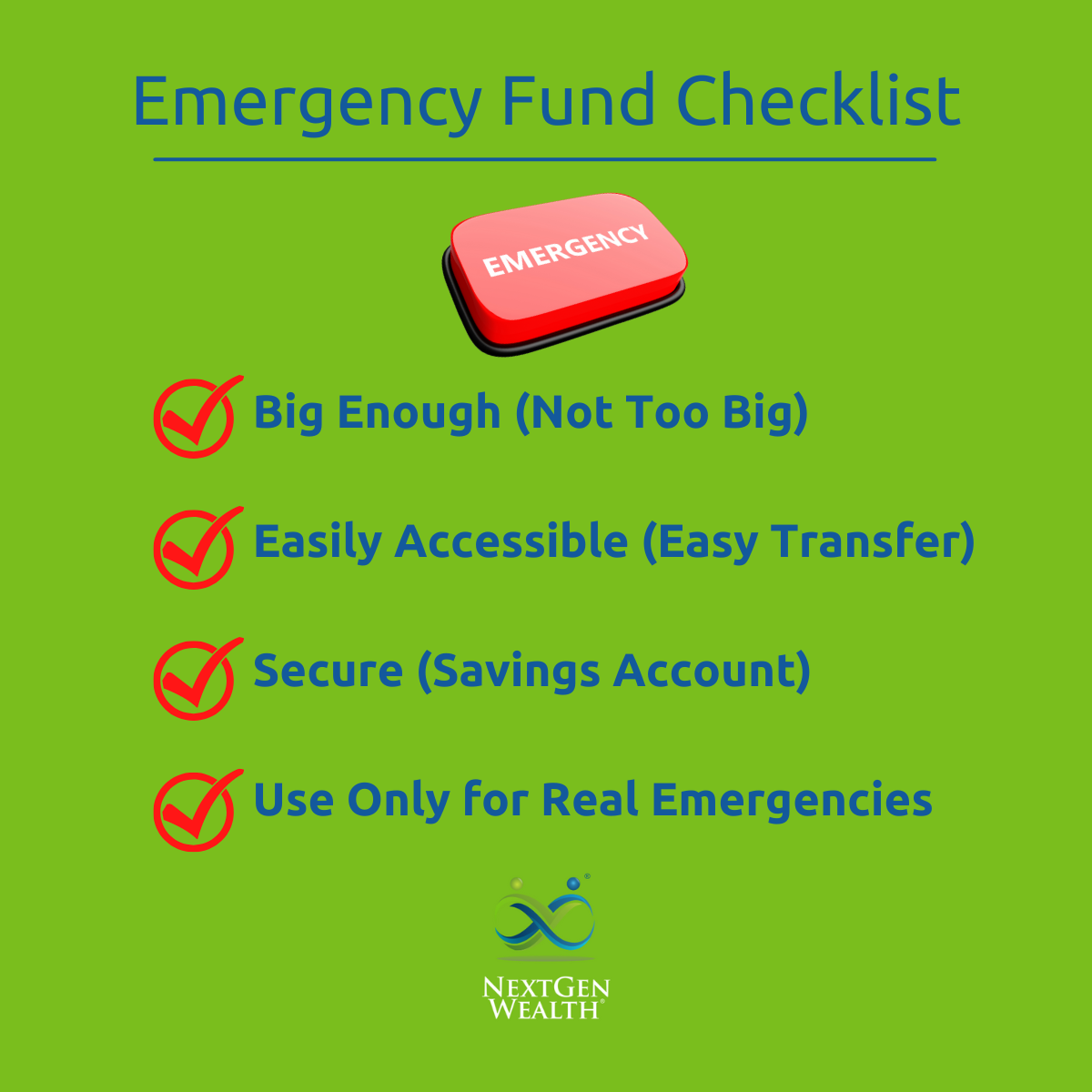

No matter how well things are going, disaster can always strike. The best way to turn a disaster into an inconvenience is to have a solid emergency fund. A large setback can have significant consequences for your financial stability and security.

It’s never too early to begin saving for a rainy day. You should understand how to build an emergency fund as well as where to put an emergency fund. Whether you have a $1,000 emergency fund or a $30,000 emergency fund, the same concepts apply.

The Basics of an Emergency Fund

An emergency fund is literally what the name suggests – funds set aside for an emergency. Most Americans can’t cover a $1,000 emergency. However, you’re not aiming to be “most people” are you?

You want to sleep better at night and reduce your stress when an emergency arises. You’ll want to have an above average emergency fund. The first thing to consider is how much of an emergency fund you’ll need.

How Much to Save?

A good rule to follow is to keep between 3 and 6 months of living expenses in emergency savings. However, you might sleep better if you have a larger than average emergency fund or have lots of guaranteed income and not need as much. This really depends on your personal situation and what will help keep your stress down.

You don’t want to have too much saved back either. If you have more than a year’s worth of emergency cash sitting in a savings account, you’re probably missing out on the opportunity to have additional funds invested in the market. Inflation can erode your savings account over time, so you don’t want to lose more money to inflation.

Look at how much you spent the last six months to get an average. Multiply your average monthly spending by 3 to 6 months to calculate your minimum balance. Notice we said minimum balance – you can save more depending on what else you might want to protect against.

Think Through Worst-Case Scenarios

It might be good to think through some worst-case scenarios to make sure you’re covered should something happen. This ensures you have enough savings to cover these emergencies, but more importantly, you’ll have the confidence your emergency fund can handle these issues later. If your minimum fund balance won’t cover these scenarios, then you can increase your emergency fund goal to cover them.

Sudden Unemployment

For example, if you get laid off from work, your emergency fund will have to cover your bills until you find a new job. According to the Bureau of Labor and Statistics, the average time spent unemployed is 22 weeks, but most people are unemployed for less than 15 weeks. This means having 4 to 6 months (15-26 weeks) saved would give you good coverage.

Large One-Time Emergencies

You might have to pay for a huge expense such as a car repair, house damage not covered by insurance, or a large medical bill. It’s not uncommon for some of these expenses to be multiple thousands of dollars. Consider how much a new roof or large foundation repair might cost. Also consider how much it would cost to replace a vehicle if needed.

Insurance Coverage

One thing to consider is when you should transfer some risks to an insurance company instead. For example, you wouldn’t save an emergency fund big enough to replace your house if you can pay the insurance company to assume the risk if your home is damaged.

If you determine you must save more than a year’s worth of savings to cover a particular emergency, then it’s probably a good idea to consider what insurance options you might have instead.

Where to Save Your Emergency Fund?

You want to keep your emergency funds in a safe, yet quickly accessible, place. The best options are high-yield savings accounts or money market accounts. These earn minimal interest, but you can pull the money out or transfer easily.

You don’t want to lock all your emergency funds in long-term certificates of deposit (CDs), stocks, bonds, or real estate holdings. You want these funds to be “liquid” so you can easily move funds around if needed.

Investing Your Emergency Fund

It’s tempting to invest your emergency funds in the stock market where the money can grow. This makes sense for long-term investing, but it’s not as great for an emergency fund. If you needed to access the funds while the market is down, you might be selling at a loss, which isn’t ideal.

It is okay to limit your emergency fund size to your minimum amount and then invest the rest elsewhere. For instance, you can keep 6 months of expenses in a savings account and then invest an additional 6 months in your brokerage account just in case. Regardless, your minimum emergency fund needs to be safe and accessible.

Bonds and Certificates of Deposit

When an emergency arises, you’ll probably need money immediately. You can’t wait for your funds to transfer to your checking account. CDs have penalties associated with taking the money out before the term is up – usually several months of interest payments.

Similarly, if you purchase corporate, municipal, or treasury bonds, your money is locked up for awhile or you’ll have to sell on a secondary market. This is not ideal in an emergency. Plus, if you end up needing to sell a bond before maturity, you’ll miss out on earnings.

Once again, you can use a hybrid approach here. You can keep a minimum emergency fund in liquid cash and additional funds in a bond or CD ladder.

Keep Your Emergency Fund Separate

You want to keep your emergency fund separate from other accounts. Having a separate account for emergencies makes it easy to maintain. You can open a separate high-yield savings account and nickname it so you know what it’s for.

Be aware of any specific requirements like minimum balances or maintenance fees. Most banks offer free checking and savings options.

What Constitutes an Emergency?

An emergency is an actual need which your regular income won’t cover. However, you are the ultimate authority over when and how to use your funds. Here are some questions to help you determine when to dip into your emergency savings.

- Can your next paycheck cover this expense?

- Is this expense immediately necessary? Or can you wait and save money to pay for it?

- What are the consequences of waiting to make the purchase?

- Do you have insurance to cover the emergency?

Your emergency fund is there when you really need it, not just to make life more convenient. A good tactic is to pretend the money doesn’t exist until circumstances require you to pull it out. This is why having the cash in a separate account is a good idea - out of sight, out of mind.

Following this strategy helps you maintain your fund for the long term and helps you get creative when paying for unexpected expenses. Another way of thinking about it is like this, “If I pull money out now, how long will it take for me to replace it?”

If you’re able to replace the funds within a month or two, maybe it wasn’t a big emergency after all.

Tips for Creating Your Emergency Fund

If you calculated your emergency fund needs and the number shocked you, don’t worry. You can start out with a smaller emergency fund and slowly work your way toward your goal. It might take a while to get there, but any progress is better than no progress.

Start Small

If you can get even $100 to $1,000 to start your emergency fund, you’re already better than you were yesterday. You can start putting extra cash in the fund on a regular basis and you’ll be amazed at how quickly you’ll reach your goal.

Better yet, commit yourself to regular deposits into your emergency fund. Automating savings is a tried-and-true method for making saving easier.

Pay Yourself First Before Paying Bills

Setting up automatic deposits or payroll deductions for your savings goals makes saving easy. You can’t spend the money if it never hits your checking account. This also helps you commit to the goal and make it happen.

If you can start with a $1,000 emergency fund and your final goal is $20,000, you can determine specific savings targets along the way. Maybe you can only commit $200 per month toward your goal initially and that’s okay.

Over time, you can increase your savings as you get raises or decrease expenses. You can also throw big chunks of cash in as you get them. If you get a bigger tax refund than expected, you can put it toward your emergency fund.

Emergency Fund vs. Debt Repayment

One of the most common questions individuals ask is whether they should save money or pay off debt. The answer can change based on your circumstances but getting at least one to two months’ worth of emergency savings is important.

Then you can look at splitting your savings between beefing up your emergency fund and paying down high interest debt like credit cards. Once the debt is paid off, you can focus on building your emergency savings fund.

Emergency Fund Versus Slush Fund

A slush fund is what we’d call general savings for a variety of purchases. If you want a new outfit or want to go on vacation, you can use a slush fund to pay for it. There’s still no set amount you should have or even need to have “extra” savings at all.

An emergency fund is much different. Overall, you shouldn’t dip into your stash for non-emergency expenses. It’s best to set up separate accounts for both purposes - one for emergencies and one for fun.

The important thing is your emergency fund doesn’t get raided for anything except true emergencies.

Now is the Time for an Emergency Fund, Not Later

The sooner you start building your emergency fund, the better. You’ll be glad you did in the future. Even if you don’t ever have to use the emergency fund, the peace of mind it brings is priceless.

A healthy emergency fund can take a crisis and turn it into a minor annoyance instead.