Important Retirement Plan Contribution Deadlines for 2025

This post was last updated on December 31, 2024, to reflect all updated information and best serve your needs.

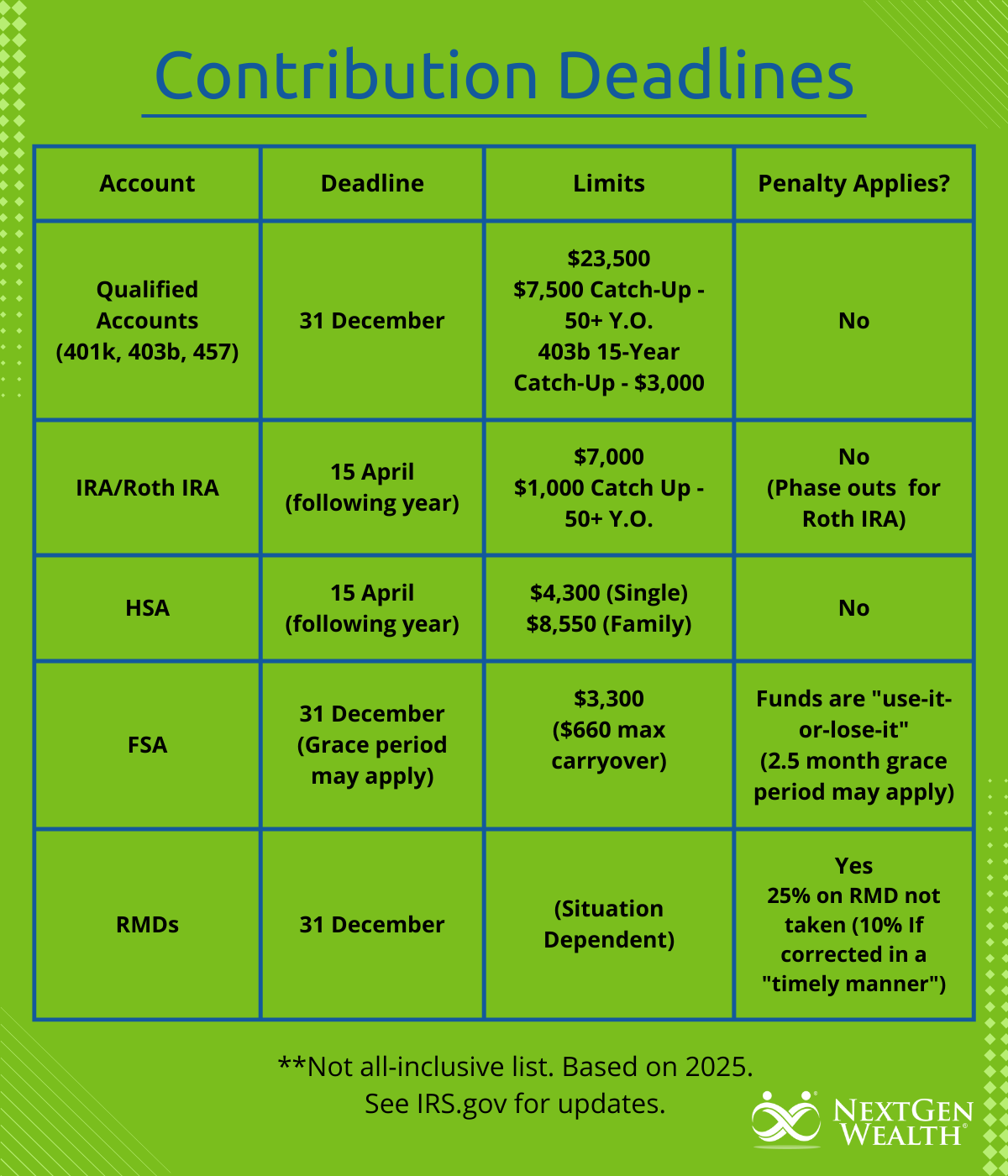

Make the most of your retirement planning in 2025! No matter how much time between now and these deadlines, mark your calendar so you don't miss anything. Now is the time to prepare for retirement account contributions (or withdrawals).

There are always new rules to consider, as well as old regulations affecting your contributions and potential tax burden. Here is what you need to know about retirement plan contribution deadlines for 2024.

Contributing to Your 401k Plan

One of the most effective options you may have to save for retirement is a 401k. Since you can put a sizeable amount into this account ($23,500 in 2025), this is a great way maximize your retirement savings goals. If you’re at least 50 years old, you can add another $7,500 to your total, bringing your total contributions to $31,000 for the year.

The deadline to contribute to your 401(k) for the year is December 31st. However, your contributions to the plan are almost always through payroll deductions. If you’re not planning your payroll deductions carefully, you may miss the deadline or max out too soon.

Maximize Your Employer Match

If you get an employer match, you'll want to spread your contributions out over the year to take advantage of "free" money from your employer. Technically, you earned it regardless - you may as well get the match.

This means you'll want to contribute evenly so you don't max your contributions until December. If you hit the max in July or August, you'll miss out on the matching contributions for the remainder of the year. You want to be right on time, not too early and not too late.

To do this, you'll want to determine how much you can and want to contribute for the year. Then divide it across 12 months and you’ll know how much to elect for salary deferral.

Regardless, if you haven’t adjusted your contribution amounts in a while, you might not be maxing your 401k - even if you were a few years ago.

Contribution Deadlines for IRAs

Individuals can contribute to an IRA until Tax Day, April 15th, of the following year. In other words, you have until April 15th, 2026, to make your final IRA contribution for tax year 2025.

This means you can contribute to your IRA or Roth IRA after you know your total income for the year. This is especially helpful if your income includes year-end bonuses, or you have a large amount of seasonal income toward the end of the year. Also, waiting to contribute helps ensure you don’t contribute to your Roth in error if you’re close to the Roth IRA contribution eligibility phaseouts ($150,000 - $165,000 filing single or $236,000 - $246,000 for married filing jointly for 2025).

The maximum amount for IRA and Roth IRA contributions is $7,000 ($8,000 for those 50 and over). So, if you haven’t reached $7,000 for 2025, you might want to take one final look before tax time and decide if you want to contribute. Overall, this deadline gives you a bit more flexibility when planning for retirement savings.

Health Savings Accounts and Flexible Spending Accounts

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), make sure you’re maximizing these benefits.

Health Savings Account (HSA) Deadlines and Limits

HSAs are a great tool for saving for medical expenses during your working years and into retirement. You must make contributions by April 15th of the following year (April 15th, 2026, for 2025 contributions). The annual limit for 2025 contributions is $4,300 for individuals and $8,550 for a family (additional $1,000 catch up for anyone age 55 and up).

The HSA is great because contributions are tax deductible, you’re able to invest the money for growth, and the money you pull out for qualifying expenses is tax free as well. You can carry over contributions too. It’s kind of a “win-win-win” scenario.

Flexible Spending Account (FSA) Deadlines and Limits

An FSA is another type of account you can contribute to for medical expenses. Normally, you must use all the funds by December 31st. Your employer may allow for a grace period.

The 2024 FSA contribution limits increased to $3,300 with a maximum carryover of $660. Keep in mind your employer determines whether any carryover is allowed.

College Savings Deadlines for 529 Accounts

If you’re saving for college for children, grandchildren, or yourself, the deadline for most states is December 31st. However, some states allow you to make contributions until April 15th. Contributions to 529 plans aren’t deductible at the federal level, but many states offer income tax deductions or credits.

Required Minimum Distributions

If you’re subject to required minimum distributions (RMDs), you normally have until December 31st to take the required distribution amounts. If not, you’ll be subject to a 25% penalty on the amount not withdrawn.This penalty can be reduced to 10% if corrected in a "timely" manner.

If you turned 73 in 2024, you’ll need to take your first RMD by April 1st, 2025 (or the year after you turn 73). In 2033, the beginning age for RMDs will become age 75 due to the changes in Secure Act 2.0.

Keep in mind you can also use a qualified charitable contribution (QCD) as your RMD. If you’re already donating to charity and subject to RMDs, this could be a good strategy to save on taxes.

RMDs for Inherited IRAs

Another important note is inherited IRAs must have the RMDs taken by December 31st as well. These begin the year the original account holder passed away.

How NextGen Wealth Tracks Important Deadlines

At NextGen Wealth, we use professional software to help ensure we check all these important deadlines to ensure you don’t miss anything. We also do regular reviews to ensure we still have a complete understanding of what applies to you and what doesn’t. We’re huge fans of checklists, systems, and technology to help us be as efficient and thorough as possible.