The Tax Benefits of Net Unrealized Appreciation

This post was last updated on October 27, 2022, to reflect all updated information and best serve your needs.

If the company you work for has an employee stock ownership plan (ESOP) or profit-sharing plan, you’ll want to pay close attention. Company stock in your 401(k) you could potentially be eligible for tax rules to help you save money on your taxes.

What is Net Unrealized Appreciation?

In simple terms, Net Unrealized Appreciation (NUA) is the difference between what you paid for your shares of your employer’s stock, the cost basis, and how much you sell them for.

Imagine you purchased or were granted $20,000 worth of company stock in your 401k. This gives you a cost basis of $20,000 (value of the stock when purchased/earned). Over the years your company has grown, expanded, and increased in value.

By the time you retire or leave the company, the current market value of your shares has increased to $100,000. The Net Unrealized Appreciation on the value of those shares in your retirement account would be $80,000 ($100,000 minus $20,000).

How Net Unrealized Appreciation Works

If you have net unrealized appreciation of your employer stock, you have the ability to treat those gains differently for tax purposes. There are a few key things to remember.

- Assets must all be transferred in a lump sum (by the end of the year) out of the employer plan

- Transfer must be in the form of stock in-kind; you can’t sell the shares and then transfer. You must transfer the shares and then sell.

- All other rules and penalties still apply (10% penalty for distributions before age 59-1/2, etc.)

- Taxes are due for the cost basis in the year of the distribution

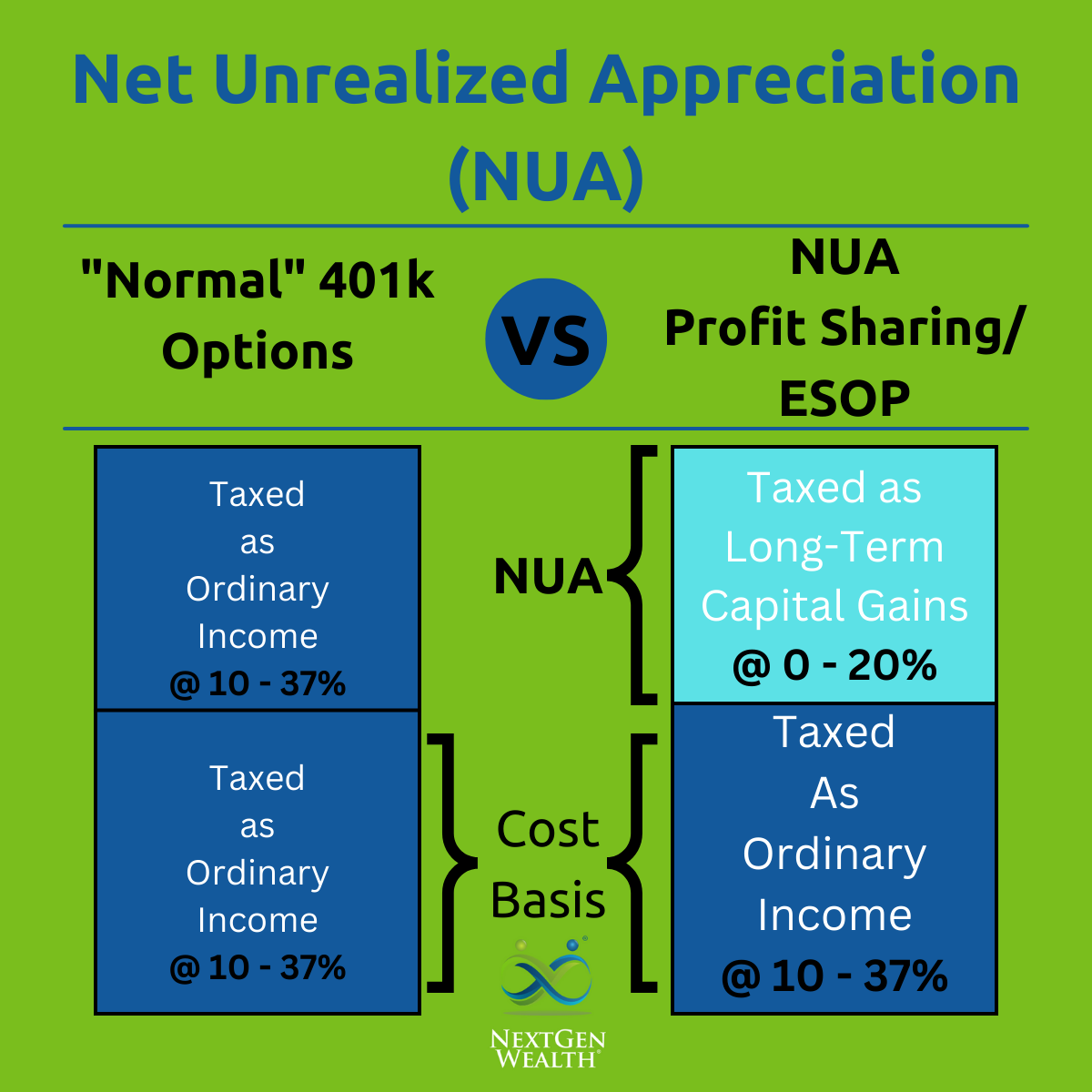

Normally when you take a distribution from a qualified account (401(k), IRA, etc.), the entire distribution is treated as taxable income. However, with the NUA allowance, only the cost basis (value when purchased/earned) is taxed as normal income. All the gains are treated as long-term capital gains for tax purposes when sold.

In our scenario above, if you had a cost basis of $20,000 on a $100,000 distribution, then you have $80,000 in net unrealized appreciation. The $20,000 would be taxed as normal income, the $80,000 would then be taxed at long-term capital gains rates.

Advantages of Net Unrealized Appreciation

An NUA strategy is best for people with a large amount of appreciated company stock in their 401(k). The ability to treat the gains from your employer stock as long-term capital gains could save you a significant amount of taxes long-term. Keep in mind, the lower the cost basis (cost when acquired), the better.

Depending on your adjusted gross income (AGI) and filing status, your long-term capital gains rate could be 0, 15, or 20 percent versus ordinary income starting at 10% and increasing to 37%.

If you expect to have retirement income reaching into the 22% tax bracket and beyond, then this could be a real win for you.

Disadvantages of Net Unrealized Appreciation

One of the major downsides of rolling over those assets (stock) from your employer’s 401(k) is you must pay taxes on your cost basis immediately as ordinary income. In our scenario, you’ll pay taxes on an additional $20,000 of ordinary income. If you had a much larger amount, say $500,000 total with a $100,000 basis, those gains can push you into higher income brackets.

Running calculations can be confusing. You have to balance paying more taxes up front versus paying less in taxes later. Also, if you time your NUA strategy poorly, you could end up raising your Medicare premiums or causing other issues.

NUA Criteria

There are specific criteria you need to meet to take advantage of an NUA strategy. We spoke about these briefly, but these criteria are key:

- You must have shares of your employer’s stock in a qualified, employer-based retirement account. This includes any company stock as part of an ESOP, 401(k), pension, or stock bonus plan. The shares could have been purchased with pre-tax contributions or a company match.

- There must be a “qualifying event” for NUA strategy to be an option. Qualifying events death (not preferred), leaving the company (retirement or otherwise), reaching age 59-1/2, becoming disabled and unable to work (defined by law).

- Distributed in a lump-sum payment. This means the entire account balance is removed by the end of the year of the distribution. You cannot make any other distributions and then later attempt the NUA strategy unless there is another qualifying event.

You can roll everything besides the company stock into an IRA and continue to let it grow. Once again, you cannot sell the shares and then transfer. You must transfer the employer shares “in-kind” to a taxable account. You don’t have to sell the shares immediately, but you may want to in order to diversify your portfolio holdings.

Considerations in Favor of a Net Unrealized Appreciation Strategy

If you have a large amount of company stock with a lower cost basis, then implementing an NUA strategy can be helpful. Otherwise, it’s probably not worth the trouble. This strategy can also be helpful if you have a single year where you’ll have a significant drop in earnings, such as your first year(s) of retirement before you draw Social Security benefits.

This strategy might be a good one to keep in mind for unique situations in the future. Regardless, it’s worth doing some basic research into what benefit you might get from taking advantage of net unrealized appreciation.

Alternative Options to NUA Strategies

An NUA strategy is only one arrow in the quiver. There are other great alternatives – including doing nothing at all. Regardless of what you do, remember the end goal which is to create a retirement lifestyle tailored to you.

Roth Conversions

If you have a large 401(k) balance, you might want to look into Roth conversions as well. These can be completed at the same time as an NUA strategy as well. Keep in mind though, the lump sum distribution of the employer stock will raise your tax rate, so this may not be the greatest time to do a Roth conversion.

Rollover and Diversify

You can certainly roll the entire balance over to an IRA and then diversify your holdings. This could open many investment options outside those offered by your 401(k). You may find much lower fee options as well.

Regardless, this is a common procedure and requires little effort or paperwork. You’ll need to fill out some paperwork, get some things notarized (or get a Medallion Signature). If you’re working with an investment advisor or financial planner, they should be able to do a lot of this legwork for you.

Let It Be

In the words of John, Paul, George, and Ringo, you might want to just “let it be.” The 401(k) is a tax advantaged account offering many benefits. The biggest risk of not doing anything is the lack of diversification if your investment portfolio is tied up in a single stock.

Is Net Unrealized Appreciation the Best Choice for Me?

As always, looking at your total financial picture is going to be the best way to tell. If you don’t have company stock in your retirement plan, it’s not an option, so you don’t need to worry. However, it’s a good strategy to be familiar with in case you need it.

For people with small amounts of company stock or employer stock without much appreciation (close to the original cost basis), you also probably won’t benefit much.

Utilizing net unrealized appreciation strategies really shine when you have highly appreciated stock and significant retirement income or required minimum distributions to contend with. If you’re unsure or just want to get an idea if NUA is right for you contact us today for your free consultation.