What is a 72t Withdrawal and is it Right For Me?

This post was last updated on June 24, 2023, to reflect all updated information and best serve your needs.

Whether you’re retiring early or your financial circumstances shift unexpectedly, a “72t” withdrawal strategy might be useful. Knowing the full arsenal of penalty-free withdrawal options can help you make your money work for you regardless of what life throws at you.

If you have an IRA or another tax-advantaged retirement account such as a 401(k), you may be able to make early withdrawals without penalties. However, there are several different considerations before you start making withdrawals.

Hoping to retire in the next 5 years or less? Download our 3 Pillars of Successful Retirement Plans.

What is a Rule 72t Withdrawal?

The actual name of a “72t” withdrawal is a Series of Substantially Equal Periodic Payments (SoSEPP) – it’s a bit of a mouthful. The name 72t comes from the section of U.S. Code which allows for a penalty-free withdrawals from numerous types of retirement accounts. There are numerous rules under subsection 72(t) beyond the SoSEPP as well.

Technically, section 72(t) is the section which prescribes the 10% penalty and then lists the exceptions which include things like hardship withdrawals and the SoSEPP. Normally, any withdrawal from a tax deferred or tax advantaged retirement account is subject to the 10% penalty unless you’ve reached age 59 ½.

Withdrawing funds utilizing an exception in section 72t bypasses the early withdrawal penalty. However, you’ll still have to pay the appropriate income taxes on the withdrawn amount. Rule 72t has some very specific stipulations.

How to Qualify for Rule 72t Withdrawals

Normally, pulling money from your retirement accounts early for a sudden need is a last resort. However, if you’ve reached your retirement savings goals and are retiring early, this could be a cornerstone of your retirement income. There’s a significant difference between these two situations.

We’re going to focus on the SoSEPP (rule 72t) and assume you’ve already exhausted other methods to meet your needs or this is a deliberate part of your early retirement strategy. In order to meet the criteria for exemption from the early withdrawal penalty, you need to be separated from your employer (doesn’t apply to IRAs) and utilize one of three methods to calculate the “substantially” equal payments. Notice, they’re not called exactly equal payments because methods like the required minimum distribution method are recalculated every year.

You can initially choose between the required minimum distribution method, the fixed amortization method, or the fixed annuitization method. Generally, it’s assumed payments will continue until the account is exhausted. However, after the required time period, you may change or even stop payments later.

Change or Stop Your 72t Withdrawals

If you start with either the fixed amortization or fixed annuitization method, you can change to the required minimum distribution method one time only. Also, as long as you’ve continued payments for at least 5 years and reached age 59 ½, you can modify or discontinue payments without penalty.

The payments continue for five years or until the account holder reaches age 59 ½. The longer time period always applies. This is really important so you don’t accidentally trigger recapture taxes and interest.

Calculating Payment Amounts

When considering a 72t distribution, you must first calculate the value of your payments. The IRS allows you to choose from three different calculation methods.

The Required Minimum Distribution Method

Using the required minimum distribution method, withdrawal amounts will be recalculated each and every year. You can find the expected payment amount by dividing the account balance at the end of the year prior (on December 31st) by the life expectancy of the account holder or their beneficiary.

The life expectancy is found using the uniform life table in IRS Notice 2022-6. Depending on your age, chosen life expectancy tables, and interest rates used for the other two methods, this method will probably result in a lower payment amount. This might have advantages if you want to stay within a specific tax bracket or other considerations.

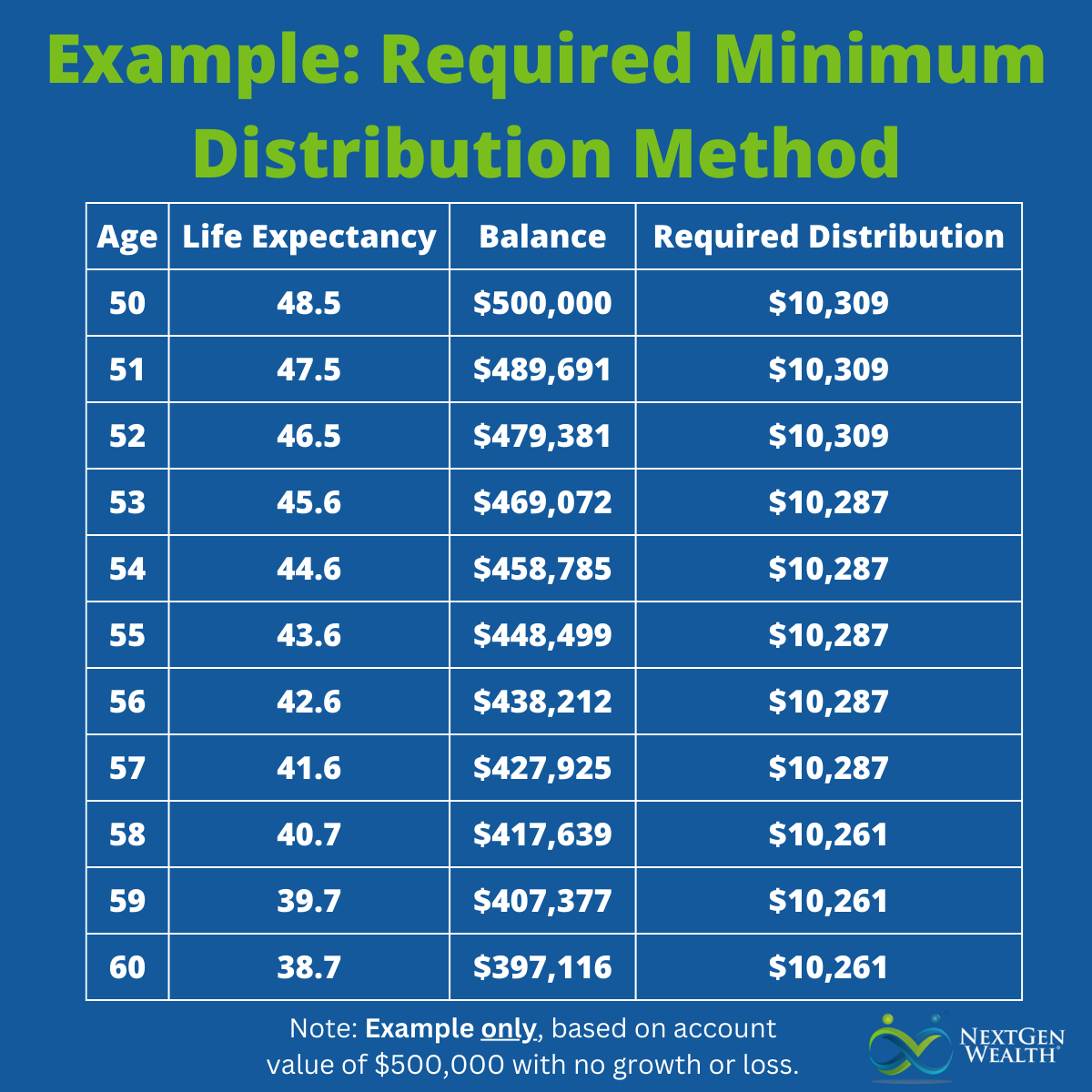

Example: If you’re 50 years old, your distribution period would be 48.5 years. For an account balance on 31 December 2022, of $500,000, you’d have a payment amount of $10,309. The following year, you’d recalculate using your current age and account balance at the end of the year previous.

For instance, if you take a distribution of $10,309 and you have no growth or loss (highly unlikely, but we’re keeping this simple), you’d have a balance of $489,691, life expectancy of 47.5 (51 years old), and a new distribution amount of, well $10,309. Just for fun, we calculated what this would look like through age 60 in the table below.

The Fixed Amortization Method

With the fixed amortization method, you’ll determine a level distribution amount which will stay the same for the life of the SoSEPP. This would be calculated similarly to any other type of level payment, which is a payment amount which stays the same.

The payment is calculated by using a set interest rate over your life expectancy or the life expectancy of you and your beneficiary using the allowable method you select. The interest rate must not be greater than 5% or 120% or the federal mid-term rate for one of the two months prior to you taking the first payment. In other words, if the payment is to start in June of 2023, we could use 120% of the monthly mid-term rate for April or May of 2023.

Example: If you’re 50 years old and select the Single Life Table, you’d have an expected distribution period of 36.2 years. You have an account balance of $500,000. The rate would be no more than the greater of 5% or 120% of the two previous monthly mid-term rates (4.88% for April and 4.21% for May 2023), so the highest rate you could use is 5% in this case. You’d have a distribution amount of $30,156 using the interest rate of 5%.

If you wanted to withdraw a lower amount, you could select a lower interest rate. For instance, using a 4% interest rate would be an annual withdrawal amount of $26,377. You have some flexibility.

The benefit to the fixed amortization method is you’ll never need to recalculate your SoSEPP again unless you later change or modify your withdrawals. The downfall is you might not want to take the higher amount versus the required minimum distribution method (using our example).

The Fixed Annuitization Method

The fixed annuitization method also results in equal annual payments. However, this calculation is more complicated. We’re not going to bore you with all the “maths” for this. However, the amount of the payments is found by using an annuity factor based on the account holder’s life expectancy or their life expectancy and their beneficiary’s age.

When to Use Rule 72t

Taking advantage of Rule 72t distributions allows you to create income from your retirement account early. Whether you’ve been forced to retire early or choose to retire early, this may be a good strategy.

Early Retirement

If you’re part of the financial independence retire early (FIRE) crowd, you’ve probably been thinking and planning around using a 72t distribution strategy for a little bit. It’s also possible you’ve just heard about it, but never really looked into the mechanics of how it would work.

The biggest thing to consider is how much income you’ll actually need once you choose a date to retire. It may be necessary to split your account up and/or transfer some of your balance to a different account. This can get complicated quickly, so be sure to keep track of all your balances and do a lot of double-checking.

Unexpected Expenses

Sometimes life throws a curveball at you. You could use a 72t to help get you through a tough financial situation. However, once you decide on a Rule 72t distribution you will be locked into it until the minimum payment period is complete (5 years and reaching age 59 ½).

You’ll want to exhaust other options of financial support before tapping your retirement accounts. We highly recommend getting a professional opinion before starting a 72t/SoSEPP strategy.

Drawbacks to Rule 72t

Locking yourself into a SoSEPP plan or messing one up can have some serious financial repercussions. So, before you start messing with your retirement accounts, keep these disadvantages in mind. Some of them might outweigh the perceived benefits of a Rule 72t withdrawal.

Once You’re In, You’re In

Stopping or altering a 72t/SoSEPP plan early carries significant consequences. You’ll have to pay penalties on all of the amounts you’ve already withdrawn. And on top of those penalties, expect to pay interest on those amounts as well.

In most cases, the money you received from your payments will be spent already to cover living expenses. So, unless you have the money to pay the penalties, you need to follow through until age 59 ½ and complete at least 5 years of distributions.

Inflexibility

If you pick the required minimum distribution method, you can’t change it. If you pick the amortization or annualization method for payment dispersal, you can only make a change once.

The Required Minimum Distribution method offers some flexibility when it comes to annual payment amounts, but this is not something you get to control. There is a set method you’ll have to use each year to calculate your payment amount.

As you saw in the chart above, the amount may not change a lot from year to year and slowly dwindles over time (depending on market conditions of course).

No More Retirement Contributions

Once you start a Rule 72t withdrawals, you can’t contribute to it anymore. This means the earlier you decide to withdraw funds the less you’ll be able to withdraw. Retirement accounts are meant for long-term savings, so digging into them too early diminishes the benefits of compounding growth over time.

Contact a Financial Advisor

If you think you might want to retire early or just want to see how prepared you are for retirement, contact us for a free consultation. The more you know about your retirement situation, the better you can plan for your retirement journey.