Why Does It Seem Like My 401k Isn’t Growing?

This is one of the most common questions that I am asked on a regular basis. It’s certainly a fair question and one that’s probably even gone through my head a few times.

We live in an instant gratification world – what have you done for me lately?” We expect to see the results of our saving and investing efforts immediately. While there are times you’ll actually notice faster growth within your investments because of a specific sector or company, for the most part it’s a long-term process.

It’s not really exciting to invest for your future and it’s even harder to visualize what the future might look like in 20–30 years. We all live in the here and now and want to see instant results. With that said, let’s take a look at a few of the reasons why it may seem like your 401(k) is going nowhere.

You’re Starting At Zero

If you’re just starting out, then you literally are starting at zero. And, unless you’re making the maximum annual contribution every year, $19,500 for those under age 50 for 2020, it’s going to take a while to see any significant growth.

You’re not alone. Everyone had to start at zero at some point. Warren Buffett started at zero. Bill Gates started at zero. Mark Zuckerberg started at zero.

Literally, every successful individual who has accumulated wealth started from zero. The hardest part is just getting started and then actually being able to envision what your 401(k) will look like 20, 30, 40 years down the road.

It Takes Time

It just takes time to see progress. If you’ve invested your 401(k) in a properly balanced allocation of stocks and bonds, you’re not going to see immediate results.For example, an annual average return of 8% is a return that most investors would be pleased with over a 20 year period. However, when you have $50,000 in your 401(k), 8% growth doesn’t seem like a whole lot in any single year.

Here’s where the power of compound growth comes into play.

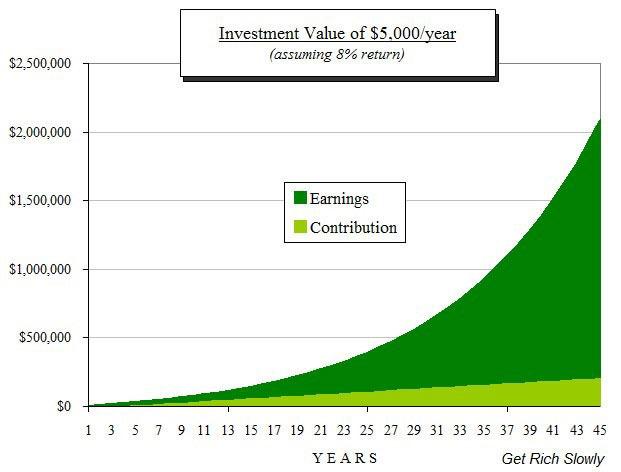

You truly don’t start to see the magic of compound growth until 10 or 20 years of saving and investing. Then you’ll finally see things start to blossom. Check out the chart below from Get Rich Slowly.

If you nvest $5,000 per year with an 8% return, it takes nearly 25 years to get to $500,000. That’s a long time! From there however, it takes less than 10 years for this $500,000 to compound to $1,000,000, and then only about another 4 years to get to $1,500,000.

It is a slow ride, no doubt. But it’s a ride you don’t want to miss out on even if it’s driving you a little crazy that you don’t think your 401(k) is growing fast enough. Patience and persistence are main keys to achieve success in investing for your retirement, or any long-term goal.

Have patience

When you’re not seeing the growth you think you should be seeing with your 401(k), you may think you need to take a different approach. Don’t!

As long as you’re your account is properly allocated in a solid mix of quality funds in your 401(k), please don’t do anything stupid like putting it all in cash or your company stock. Stick with the plan and have some patience.

We all want instant gratification. But, it truly doesn’t work that way when it comes to investing. The best investors in the world are extremely patient. As Warren Buffett says, “The stock market is a device for transferring money from the impatient to the patient.”

You must have patience. Investing takes time. To be honest, it’s not really exciting most of the time. As much as Hollywood or CNBC try to hype it up, it's really pretty boring if you're doing it the right way.

Stick To Your Plan

Even if you don’t think you’re making progress fast enough, don’t stop contributing! Stick to the plan. You’re still going to need money to retire someday, so I’m not really sure why your plan would change.

Often it’s outside influences that cause you to question your plan. If your goals haven’t changed then there’s no reason why your investments or the amount you’re contributing needs to change either.

This isn’t to say that you shouldn’t review your investments and your financial plan periodically. You absolutely should and you should make adjustments as needed. But these adjustments should be made in the context of the end goal that you are investing for.

Your goals should dictate how you invest, not CNBC or business colleagues. Have a plan and follow through with it. Distractions will come. Assess them as necessary, but don’t veer off course.

Everything I’ve written can be applied to any investment account, not just your 401(k). Also, everything I’ve mentioned here isn’t easy. If it were, we'd all be great investors. However, we're human beings and we want to see things move much faster.

Anytime it seems your 401(k) isn’t growing or you want to go down a different course, come back and read this. I guarantee that your future self will thank you.