Beyond Roth: Voluntary After-Tax Contribution Benefits

Are you looking for a way to supercharge your retirement savings? You might want to look into after-tax contributions to your 401k. Larger employers offer this option more often, but some smaller employers may also offer it.

After-tax contributions could be a great option to top off your retirement savings. Of course, there’s nothing magical about these contributions, but if you’ve already hit other contribution limits, this might be a great benefit.

Table of Contents

- Understanding Voluntary After-tax Contributions

- How do Voluntary After-tax Contributions Differ from Roth Contributions?

- Benefits of Voluntary After-tax Contributions

- Leveraging Voluntary After-tax Contributions for Retirement Planning

- Strategic Wealth Preservation Strategies

- Building a Secure and Fulfilling Retirement with Voluntary After-tax Contributions

- How NextGen Wealth Helps with Long-term Financial Security and Peace of Mind

Understanding Voluntary After-tax Contributions

After-tax contributions are exactly what they sound like. You can contribute extra funds into your 401k up to the annual contribution limits after you’ve already paid taxes (i.e. post-tax contributions). So, instead of just getting your annual limit plus the match, you could potentially get a lot more into your 401k.

The elective deferral contribution limit for your 401k is $23,000 (2024 limits). However, your actual 401k defined benefit contribution limit is $69,000 (2024 limits). Most people (myself included at one point) think the maximum contribution limit of a 401k is the elective deferral limit, but that’s not the case.

However, if your plan allows for after-tax contributions, you could put even more into your 401k. So, if your total contributions were $23,000 and your employer matched 5% of your $100,000, you’d have $28,000 in total contributions. This means you could add $41,000 to your 401k on top of what you’ve already contributed.

Catch-Up Contributions

One quick note on Catch-up contributions. If you’re age 50 or older, you can contribute an additional $7,500 for a total of $76,500 for the year!

How do Voluntary After-tax Contributions Differ from Roth Contributions?

The main difference in making additional non-Roth, after-tax contributions versus Roth contributions is the tax treatment and contribution limits. In both cases, you’re taxed on earnings before contributing to your 401k. Any earnings will not be taxed for Roth contributions, but non-Roth after-tax contribution earnings will be taxed.

The earnings on after-tax contributions inside your 401k will be taxed as ordinary income when you withdraw – not capital gains tax treatment. This is different than if you had just contributed to a Roth IRA or a taxable brokerage account. So, what’s the real advantage here?

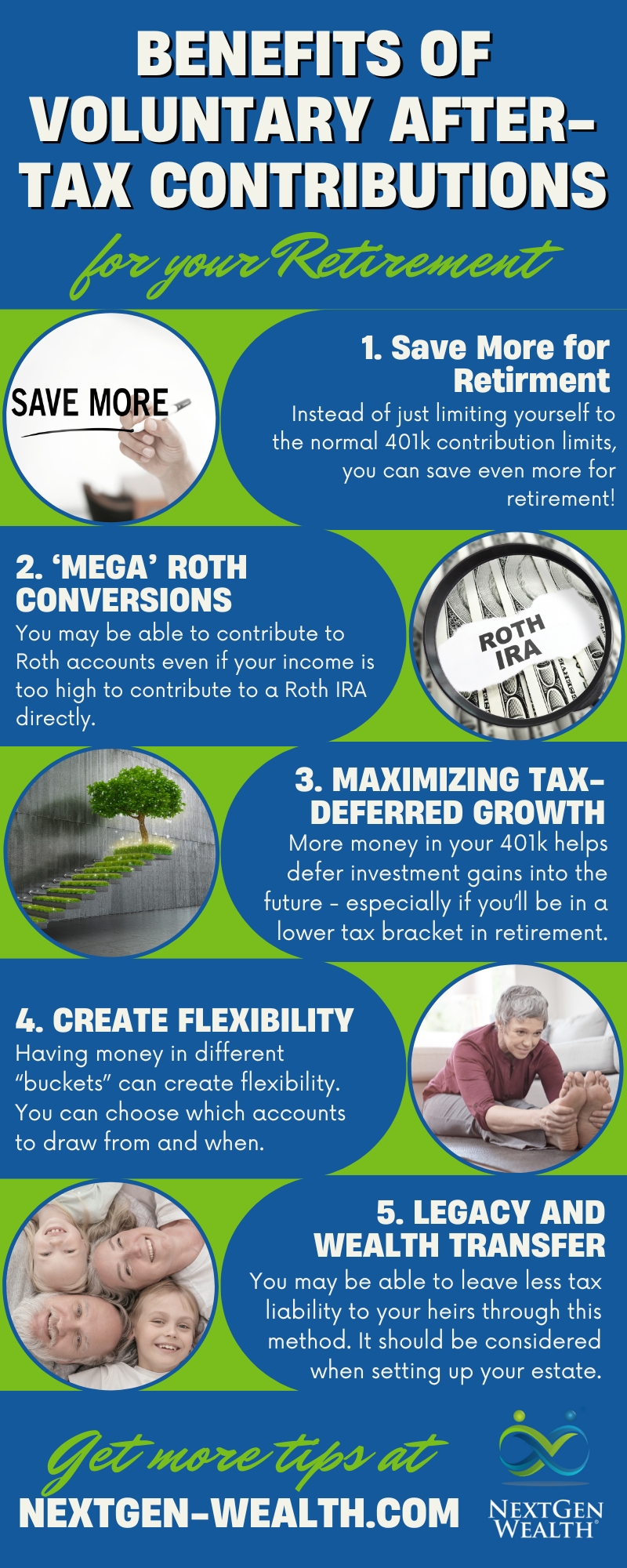

Benefits of Voluntary After-tax Contributions

The real benefits of after-tax contributions come from the ability to complete rollovers to your Roth IRA. Your employer must allow for both after-tax contributions and in-service rollovers. This would allow you to complete in-service Roth IRA conversions and get more money into your Roth IRA – this is often referred to as a “Mega” Backdoor Roth Conversion.

However, considerable planning is needed here because of the “pro rata” distribution rules for after-tax contributions. You can’t just transfer the after-tax portion to your Roth IRA. These distributions will be treated as if you’d distributed equal parts of all contributions—not just the after-tax portion.

Example of After-Tax Distributions

For example, if you had a traditional (non-Roth) 401k balance of $250,000 and $50,000 consisted of after-tax contributions, any rollover would comprise 20% after-tax contributions and 80% pre-tax contributions. If you completed a direct rollover from your 401k of $50,000, only $10,000 would be from the after-tax portion.

In other words, you can’t fully convert the after-tax portion of your 401k to Roth unless you roll over the entire balance. However, there are always exceptions.

Creative Distribution Allocation

The IRS allows you to split the distribution into different accounts and treat it as one distribution. This can get confusing, so you’ll want to work with your accountant, financial planner, and 401k plan administrator to ensure everything is properly documented.

This allows you to roll the pro rata share of pre-tax contributions into a traditional (non-Roth) IRA and the after-tax amounts into a Roth IRA. In other words, you can roll over a portion of your 401k without creating a taxable event.

You must be careful not to withhold taxes from the direct rollover. You want to move the entire amount to the new account; otherwise, you could end up getting hit with the 10% penalty if you’re not age 59-1/2 or older. Once again, your financial planner, accountant, and plan sponsor should be involved in helping you do this.

We’re looking for a result of contributing more to the Roth IRA so that the earnings on your principal will also be tax-free. Otherwise, only the principal (the original money you contributed after tax) will be tax-free, and the earnings will be taxed as ordinary income (and we definitely don’t want that).

Leveraging Voluntary After-tax Contributions for Retirement Planning

Contributing after-tax dollars could have some major benefits. As we mentioned, this can still be worth it even if you can’t do in-service Roth conversions/transfers.

Maximizing Tax-deferred Growth

Having more money in your 401k helps you defer more investment gains into the future. This could pay off if you anticipate being in a lower tax bracket in retirement. Remember, you’ll have to pay ordinary income taxes on the investment gains of your after-tax contributions but not your principal.

Let’s say you put $50,000 of after-tax funds into your 401k, and there was another $50,000 of growth, totaling $100,000 in the account. When you withdraw the full $100,000, you’d only owe taxes on the $50,000 growth – not the $50,000 of principal.

Strategic Wealth Preservation Strategies

Having a diversified portfolio in terms of both asset allocation and asset location can be very helpful. Having money in different accounts or “buckets” can create flexibility. You can choose which buckets of money to use and when.

If markets are up, you may want to use one bucket of money. When markets are down, you may choose a different account to pull from. Having different tax treatments can help you adjust your retirement income streams as things change.

Enhancing Retirement Income Streams

As you transition into retirement, you’ll have many opportunities to maximize your income streams. At NextGen Wealth, we regularly analyze the best time to start drawing Social Security, implementing tax-saving strategies, and coordinating other benefits such as Medicare.

For instance, having some after-tax contributions can allow you to get more money into Roth accounts through Roth conversions. This may help you reduce your required minimum distributions (RMDs) later in retirement. This can also benefit your surviving spouse if you passe away first.

Building a Secure and Fulfilling Retirement with Voluntary After-tax Contributions

After-tax contributions are another tool for saving on taxes and securing a successful retirement. If you can’t contribute directly to a Roth IRA and you’ve already maxed out your Roth 401k, this could be a major help.

Legacy Planning and Wealth Transfer Opportunities

There’s also a lot to be said about legacy planning and gifting as well. We wouldn’t suggest changing your estate plan just to incorporate this strategy, but you may be able to leave less tax liability to your heirs through this method.

Having money with taxes already paid is very different from inheriting a traditional 401k with all pre-tax money. There’s a 10-year window for inherited 401ks to be withdrawn, so this could create a significant tax burden.

These things should definitely be considered when thinking about how to set up your estate and how to fund your legacy goals.

How NextGen Wealth Helps with Long-term Financial Security and Peace of Mind

No matter what, we want you to achieve your goals efficiently and stress-free. At NextGen Wealth, we regularly analyze a variety of tax-saving strategies and how they can benefit our clients. To see if we’re a good fit for you, please contact us today for your free financial assessment.