The Best Money Saving Tips for College

Do you have a child that might go to college someday? If so, then you’ve come to the right place. In this article, we provide you with our best college savings tips regardless if your child is 10 years away or 1 year away. We have tips for all of them.

Let’s face it, saving and paying for college can be overwhelming. Knowing how much to save for college, what types of accounts to utilize (529 Plans, UTMA/UGMA accounts, IRA’s, etc) and how to invest the money, can lead you into paralysis by analysis.

And, that’s only when you’re actually saving up for college.

Once your child gets within a couple of years of attending, you now have a whole new set of questions to ask.

- How do I even begin the process of finding the right college?

- Do I have enough saved for college?

- What’s FAFSA and the CSS Profile?

And, the list goes on and on and on.

I think you get the point we’re making. I hear you loud and clear.

That’s exactly why I created this article so I could share with you some of my best college savings tips that I normally reserve just for clients. Of course, these are simply general rules of thumb so please don’t feel like all of them will apply to you.

However, some will and I can almost guarantee that you’ll learn something new. Feel free to share your feedback and reach out if you have any questions.

You never know, but some of these might just save you a few thousand dollars.

Saving For College

- A good goal is to save around 25-50% of what you believe will be the cost of college

- Check out this article: Experts say this is how much you should save for college

- Here is a link to a good college savings calculator from Fidelity: College Savings Calculator

What You Need to know about 529 Plans

- If you decide your goal is in the 25-50% range then I would recommend saving that money in a 529 plan. If you are wanting to save more than 50% for college, then I would cap the 529 account at 50% of estimated college costs and save the rest in a taxable account that is earmarked for college. This will allow you more access to it and so not everything is locked into a 529 plan

- Most states allow you to deduct 529 contributions from your state taxes. Check if your state allows this and if there is a cap on the maximum contribution to still get the deduction

- As an example, if your state has a 5% income tax rate and you invest $3,000 per year into a 529 plan, then your tax savings just from the state tax deduction would be ~$150 per year or ~$2,700 over 18 years. This doesn’t even account for the tax-free earnings on the 529 investments

- Some states even allow the state deduction regardless of what states 529 plan you are utilizing. This allows you to pick from the best of the best 529 plans and still get your state tax deduction. Find your state in the link above to see if you’re lucky enough to live in one of those states

- Click on the next link to see the top rated 529 plans from Savingforcollege.com. If your state doesn’t allow a state tax deduction or allows you a state tax deduction regardless of what 529 plan you utilize, then I would highly suggest going with one of the top-rated plans. Best 529 plan from SavingforCollege.com

- As for what investments to choose from in a 529 plan, I prefer the age-based portfolios where the investments are managed for you and will automatically get more conservative the closer your child gets to 18. You can always pick and choose your own funds if you prefer to be a little more hands-on

- Consider having the 529 in the grandparent's name as it will not count against financial aid eligibility as it would be in the parents or child’s name. However, it will be counted in the following year so you need to weigh the pros and cons and speak with a Certified Financial Planner® before going this route. It’s typically best to wait until junior and senior years to use grandparents 529 money

College Savings Tips Within 1-2 Years of College

- Custodial accounts (UTMA/UGMA) and accounts in your child’s name will be counted as assets in your child’s name and counted against them on their FAFSA

- Encourage your child to take college credit courses in HS. They are typically much more affordable

- If your child is within a few years of college and you’re really wanting/needing some great personalized help, then check out the services of College Inside Track

- Remember to not include your primary residence or retirement assets when filling out the FAFSA

- While you may not think you need to fill out the FAFSA or the CSS profile, because your child won’t qualify for financial aid, just completing them could be worth thousands in savings

- As mentioned above, grandparent-owned 529 Plans don’t have to be included on the FAFSA. However, they will be the following year if used to pay for college. It’s best to use grandparents money during the last two years of college for this reason

- Students should be mindful of their social media profiles. Colleges will look at them

- Spend the majority of the time finding the right college for your budget and not the other way around

- Not all colleges offer merit aid. Find those that do! Public Colleges Offer Merit Scholarships to Recruit Students - Cappex

- Consider colleges in other states. You might be surprised by the incentives

- Pay for test prep! Even a minor improvement on your child’s SAT or ACT score could be worth thousands in savings per year

- Email the college and show interest. It actually could be worth a lot of money

- Have your child get an excellent letter of recommendation

- Submitting an excellent essay could be worth thousands in savings as well

- Appeal the financial aid award. You’d be surprised at what they offer

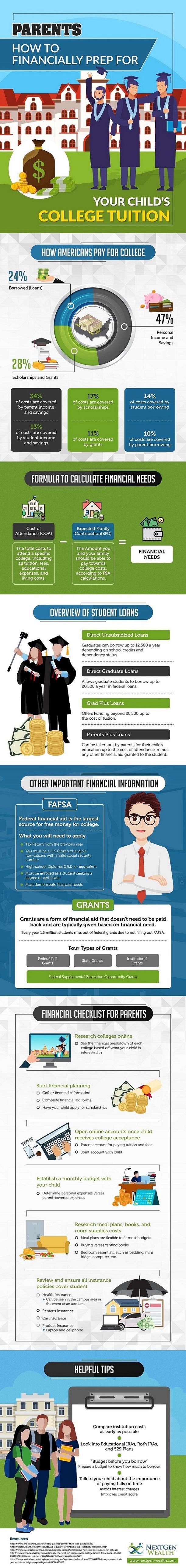

Check out this awesome infographic to learn more about how parents can financially prepare for their child’s college tuition. Feel free to share as well!

This is a post from Clint Haynes, a Certified Financial Planner® and Financial Advisor in Kansas City, Missouri. He is also the founder and owner of NextGen Wealth. You can learn more about Clint at the website NextGen Wealth.