How to Guarantee Poor Investment Returns

When it comes to investing, the hype seems to be around the next hot investment and the incredible returns it will surely produce. While that is all good and well (not really), no one ever seems to talk about what not to do when it comes to a good investment strategy.

I truly believe, if you can avoid making dumb decisions, then that will ensure you’re making the right decisions. Investing isn’t about finding the next Apple; it’s about not making those common mistakes so many people can’t seem to avoid.

Well, we will dig into what you can do to guarantee poor investment returns. If you really want to have underperforming investments, then implement these strategies. However, if you want to be a smart investor, avoid doing these things at all costs. I guarantee your investment portfolio will thank you.

Timing the market

If I had a nickel for every time I had a question about some type of market timing idea, I’d have a lot of nickels. Don’t do it! It’s not worth it! Maybe you can justify it in your mind, but rarely will you be so lucky.

Timing it once is hard enough, but then you must time it again to get back into the market. It’s not worth it. Believe it or not, plenty of people got out at the market bottom in 2009 and still haven’t gotten back into the market to this day!

The market, the media, nor the hype should dictate how you invest. As I’ve said a million times, your goals should be the only things dictating how you invest. If they haven’t changed, then there’s likely no reason to make a change.

Constantly buying and selling

This is somewhat similar to timing the market. It’s been proven the normal person’s return is 3-5% (depending on the study) less than that of someone who simply bought and held the exact same fund. That’s right; we’re talking about the exact same fund.

The reason is because some people must constantly move in and out of things because it makes them feel better to do something. Well, guess what? It doesn’t work. Doing nothing is often the right thing to do, even though it might not feel like it.

Even if you have poorly managed funds, you will be better off holding onto them long-term, rather than buying and selling all the time. Again, if there isn’t a justifiable reason to make a fund change, then don’t.

This is why I prefer investing in index type funds because I know the only thing I must ever do is rebalance the portfolio annually. With index funds, I don’t have to pay attention to manager performance, because there isn’t one. Keep your investments simple and stay in them for the long-term.

Paying too much in fees

I see this way too much. Most individuals have no idea what they’re paying in fees, and many people don’t think they’re paying anything. That’s right; people think they aren’t paying any fees on the funds they hold in their accounts.

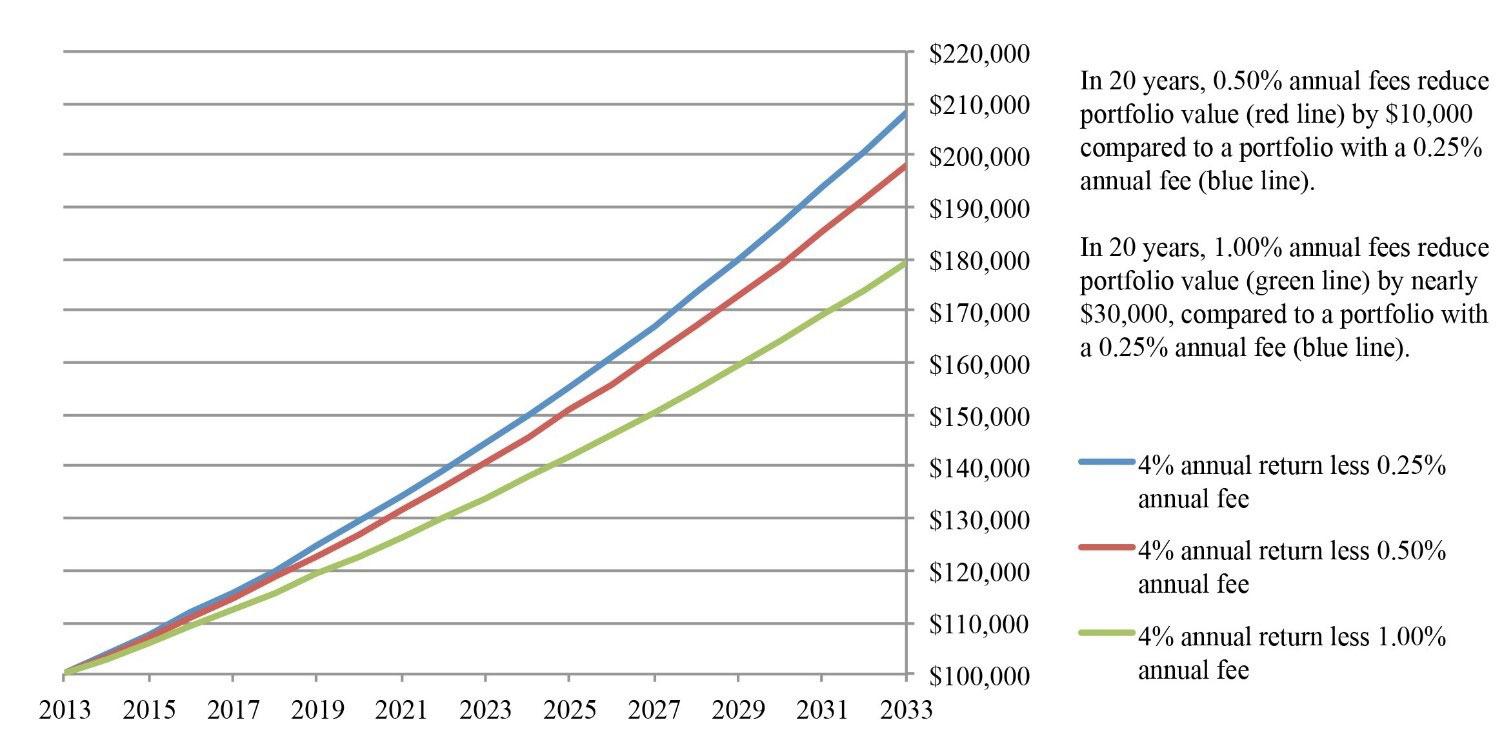

Well, you are! And, it could add up to much more than you’d ever think. Paying too much in fees can absolutely kill your performance. While .50% may not sound like much, over time, it can add up to thousands of dollars. Check out this chart from the SEC.

Portfolio Value From Investing $100,000 Over 20 Years

Amazing, isn’t it. Just a ¼ of a percent can add up to nearly $10,000 if fees over 20 years on a $100,000 account. ¾ of a percent is nearly a $30,000 difference. Know your fees.

Granted, if value is provided by having to pay additional fees then that’s one thing. However, for picking investments, I pay close attention to expenses. If you can save just ½ a percent a year in fees, you’ll be keeping thousands of dollars in your pocket. Index funds and ETF’s are great bargains for smart investors.

Taking advice from everyone

I’ll be the first to admit I’ve been in this boat before. I’ve been sold on a few stocks in my day and rarely did it end well. You are welcome to listen to CNBC or your neighbor, but it doesn’t mean you have to act on their “brilliant” investment ideas.

Take them with a grain of salt or do your own research before investing anything. The prognosticators and “gurus” always have an idea. I will allow you to listen, but I won’t allow you to act.

Following the crowd

While it’s been proven that following the crowd in certain situations makes sense, it’s clear that, in investing, it rarely works. The contrarian typically wins when it comes to investments.

When everyone is telling you to buy, have a plan for your purchasing strategy. When everyone is telling you to sell, this is when bargains can be found. Don’t listen to the crowds. Form your own opinion.

When so many people were screaming to get out of the market in 08-09, it tested many of our wills. However, those who didn’t listen have been richly rewarded over the last 8 years.

So, there you have it. Following these steps will guarantee you poor investment returns. However, doing the opposite will ensure you’ll be better off than most investors. What direction will you choose?

This is a post from Clint Haynes, a Certified Financial Planner® in Lee’s Summit, MO. He is also founder and owner of NextGen Wealth. You can learn more about Clint at the website NextGen Wealth.