The Importance of Asset Location for Tax Planning

Are your retirement assets in the right location? Asset location can be critical to saving money on taxes. Many people know about asset allocation or diversification, but there are a lot of nuances around what types of accounts are used for what assets.

The deliberate placement of your investments can be critical for your long-term success. Don’t assume everything is where it needs to be. As you move through different phases of retirement, you may also need to shift things to meet your needs.

Table of Contents

Understanding Asset Location

Asset location is exactly what it sounds like – where you’re keeping assets. However, there’s a little more to it than simply which account type you use. Asset location is based on the tax treatment of different assets and the type of “wrapper” to put them in.

For instance, if you have a large amount of corporate bonds in your portfolio, you might not want them in a taxable brokerage because the regular coupon payments would be taxable as they’re paid out. Assets like index funds and ETFs might be better options for your taxable account because they can qualify for potentially lower capital gains tax treatment.

Why Asset Location Is Crucial for Tax Planning in Retirement

When you can shift assets to the most favorable account types, you can gain some control over taxes. This can be especially important when trying to implement a Roth conversion strategy. We want to control when we realize income so we’re not forced to pay taxes at unfavorable times or rates.

As an example of poor asset location, many investors inadvertently got hit with extra taxes from holding target date funds in their taxable accounts. Target date funds often hold taxable bonds and often require regular buying and selling for rebalancing. This can generate taxable income and capital gains.

In other words, there are some assets you shouldn’t hold in a taxable account (unless you really want to pay those taxes now).

Core Differences in Account Types and Asset Classes

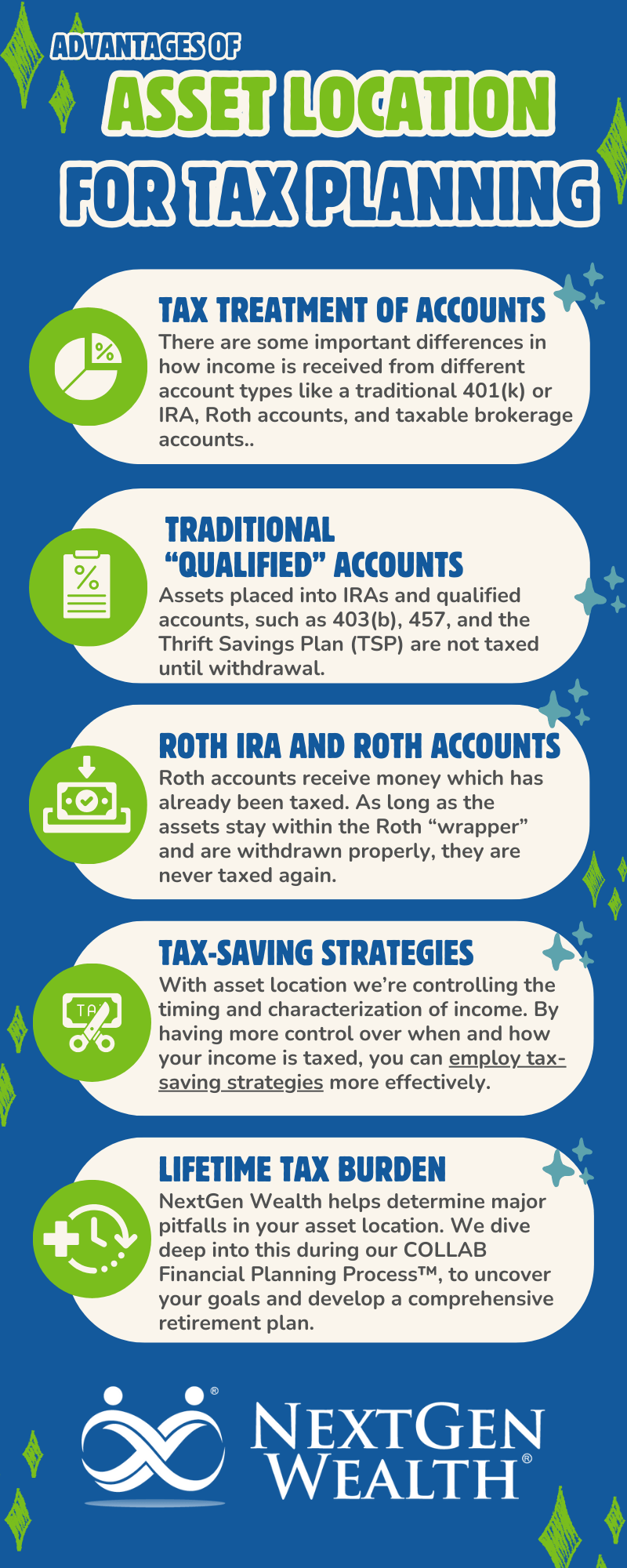

There are some important differences in how income is received from different account types. For our discussion here, we’ll focus on the more common accounts retirees will have, like a traditional 401(k) or IRA, Roth accounts, and taxable brokerage accounts.

Traditional Defined Contribution Accounts and IRAs

The 401(k) has largely become the most widely used and recognized defined contribution retirement account. However, the tax treatment of IRAs and qualified accounts, such as 403(b), 457, the Thrift Savings Plan (TSP), and others, is similar.

Assets are placed into these accounts, and the principal and gains are not taxed until withdrawal. Then, the withdrawals are counted as ordinary income. This is important because dividends, coupon payments, and unrealized gains are not “recognized” by the IRS for tax purposes while inside the account.

Roth Accounts

On the other hand, Roth accounts are attached to qualified accounts, and Roth IRAs are taxed differently. Roth accounts receive money that has already been taxed. Then, the money grows tax-free, and if the rules for qualified distributions are met, any gains are also tax-free.

Similar to other retirement and tax-advantaged accounts, income received from assets within the account stays insulated from taxes while inside the account. Better yet, if the assets remain within the Roth “wrapper” and are withdrawn properly, they are never taxed again.

Taxable Brokerage Accounts

Another place you can hold assets is in a taxable brokerage account. These accounts don’t have nearly as many tax benefits. Dividends and interest payments are taxed on an accrual basis (once earned).

Capital gains (the difference between what you paid for an asset and what you sell it for) get some favorable tax treatment. However, it’s important to remember capital gains are included in your Adjusted Gross Income (AGI) and can push you into higher tax brackets.

So, what does all this mean? You need to be deliberate about where you hold investments.

Strategies for Optimizing Asset Location

The main objective is to pay the lowest amount of taxes over your lifetime. This sounds simple, but optimizing taxes can be an incredibly complex task. Proper asset location is one way to accomplish this.

Depending on which phase of retirement you’re in and your income levels, locations may change over time. For instance, earlier in your career, you might not have received much of an advantage from getting additional deductions from income for retirement account contributions. You might also be able to receive dividends and interest at lower rates.

Paying Close Attention to Timing

One of the main things we’re trying to do with asset location is control the timing and characterization of income. For instance, when you hold an asset in an account that causes you to receive (and “recognize”) gains immediately, you don’t have much control. Holding a dividend-paying stock or coupon payments from bonds in a taxable brokerage account creates a constant stream of income.

You don’t have control over when you receive a dividend or coupon payment. Therefore, you can’t control the timing and resulting taxation.

On the other hand, an exchange-traded fund (ETF) or individual stock that doesn’t pay dividends only generates income when you sell. This allows you to control the timing better.

The Role of Smart Asset Location in Tax-Saving Strategies

You might be wondering, “How does this save me money?” It’s a fair question to ask. You can employ tax-saving strategies more effectively by having more control over when and how your income is taxed.

Some tax-loss and tax-gain harvesting strategies can only be employed in taxable accounts. You can even use these to offset other gains or losses as needed. If you’re trying to maximize Roth conversions, being able to “shut off” other streams of income temporarily can help you pay taxes at the lowest possible rate.

Remember, we’re zooming out to look over your entire financial life.

How to Get Started with Asset Location

The first step in researching whether you need to adjust your asset location strategy is to account for everything you currently have. You also need to assess the merits of moving money around.

If all your money is in your 401(k), you might not benefit much from trying to move assets. Any qualified withdrawal will be taxed at ordinary income, so you’ll need to optimize for those withdrawals first. The story will change a bit if all your money is in a taxable brokerage.

Understanding How Your Current Assets Are Taxed

Understanding your current tax situation is the other major component to determining if you need to make an asset allocation change. We all know the importance of asset diversification, but there’s more to it. We recommend understanding your financial needs, building the portfolio to support them, and then layering in tax optimization.

You may not need to make massive shifts at all. You can gain some tax efficiency simply by switching some of your investment holdings.

Zooming Out and Taking a Total Portfolio View

The last key piece to think about when considering asset location is viewing the whole picture. For instance, just because you’ve decided on a particular ratio of stocks and bonds is best doesn’t mean each account is split exactly the same. You could hold most of your taxable (corporate) bonds in your 401(k) or IRA and most stock holdings in your taxable accounts.

When you zoom out to look at your entire portfolio, you’ll still get the benefits of diversification even though your assets are in different accounts. You can adjust where you pull money based on current market conditions or your tax situation. This can allow you to shift income received for tax purposes and help create space for implementing tax strategies like Roth conversions.

The bottom line is this: it’s best to take a comprehensive approach to asset location to account for your situation. This is how we work with clients to establish a solid retirement game plan. We want you to fully understand your retirement portfolio's why, when, and where.

How NextGen Wealth Helps with Asset Location

NextGen Wealth can help determine any major pitfalls in your portfolio construction and asset location. We’ll dive deep into this during our COLLAB Financial Planning Process™, where we uncover your goals and develop a comprehensive retirement plan.

We’re constantly working to optimize our clients’ financial lives for what matters most—living a stress-free and fulfilling retirement. Contact us today to see if we’re a good fit and get your free financial assessment.