How Kansas City Seniors Can Save on Kansas Property Taxes

There are many rising costs senior citizens have to contend with, but your property taxes might not be one of them anymore. We took a look at programs affecting the Kansas counties surrounding Kansas City to see how you can save on property taxes. The ability to “freeze” or lock in your current property tax costs using the Homestead Act is one potential option.

You may also be eligible for other programs to assist with your property tax bills. However, there are rules and restrictions to qualify. If you’re on the Missouri side of Kansas City, check out our article on Kansas City, Missouri programs.

Table of Contents

Overview of the Kansas Property Tax Freeze

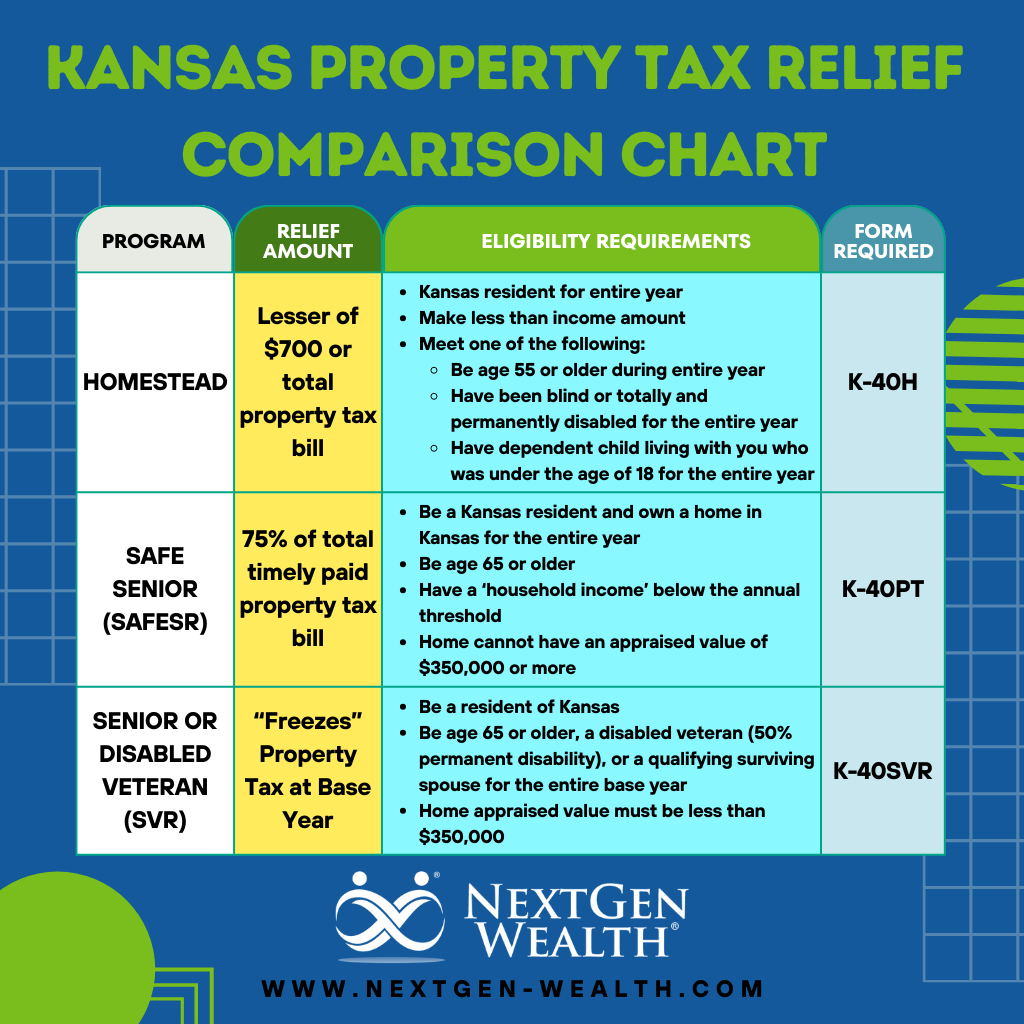

Depending on your circumstances, you may qualify for one of three different property tax relief programs for seniors (and disabled veterans). These programs are the Homestead, Safe Senior (SAFESR), and Senior or Disabled Veteran (SVR) programs.

The Kansas State Revenue Neutral Rule

In addition, Kansas requires individual counties to decide each year whether to collect additional property tax revenue. This is part of their “revenue neutral” rules. For instance, the Unified Government of Wyandotte County and Kansas City, Kansas, recently voted to freeze property taxes.

However, this is slightly different from the other programs we mentioned. We’ll touch on each of those programs briefly.

A Quick Note on Program Forms

We’ll note the forms used for each program because we felt following the forms was the easiest way to distinguish between each program. You can only file one form, and filing for one program makes you ineligible for the other programs for the year. We also created a chart below the program descriptions to help keep things straight.

Now, let’s run through all the different programs.

Homestead Refund Program

Under the Homestead Refund Program, eligible Kansas residents could receive a refund equal to the lesser of $700 or their total property tax bill. To qualify for the refund, you must:

- Be a Kansas resident for the entire year.

- Make less than the threshold amount ($40,500 for 2023)

- Meet one of the following criteria:

- Be age 55 or older for the entire year

- Have been blind or totally and permanently disabled for the entire year.

- Have a dependent child living with you who was under the age of 18 for the entire year.

For more information, visit the Kansas Department of Revenue website. To request a homestead refund, use form K-40H.

Safe Senior (SAFESR) Program

The Safe Senior (SAFESR) property tax program allows eligible seniors to receive a refund of 75% of their total timely paid property taxes. The program has specific eligibility requirements, which are:

- Be a Kansas resident and own a home in Kansas for the entire year.

- Be age 65 or older.

- Have a ‘household income’ below the annual threshold ($23,700 or less for 2023)

- Home cannot have an appraised value of $350,000 or more.

Additional information and frequently asked questions about SAFESR are available here. The K-40PT form, which is used to request SAFESR, can be found here. You must include all Social Security income in your ‘household income, which may put you over the income limits.

The Senior or Disabled Veteran (SVR) Program

This is what might be referred to as the “tax freeze” program. This program allows you to set a base year (after you turn 65, are a disabled veteran, or qualify as a surviving spouse) and receive a refund equal to the difference between the current year’s property taxes and the base year.

For instance, if you had property taxes of $1,000 for the year, and your property taxes increase to $1,100 the following year, you can request a refund of $100. Once again, this program has eligibility requirements.

The basic eligibility requirements are:

- Be a resident of Kansas.

- Be age 65 or older, a disabled veteran (50% permanent disability), or a qualifying surviving spouse for the entire base year.

- Have a ‘household income’ below the annual threshold ($23,700 or less for 2023)

- Home appraised value must be less than $350,000.

For complete eligibility requirements and information, visit the Kansas Department of Revenue website. The K-40SVR form, found here, is used to request this property tax refund.

Tax Revenue Statues of Kansas Counties Near Kansas City

As mentioned, each Kansas county must report whether they will raise property tax revenue from the previous year’s “revenue neutral” rate. Even if you don’t qualify for one of the programs listed above, you might find some tax relief from your county. We’ll briefly discuss the Kansas counties closest to Kansas City.

Unified Government (UG) of Wyandotte County and Kansas City, Kansas

After hearing remarks from concerned citizens, the Unified Government (UG) of Wyandotte County and Kansas City, Kansas, voted not to exceed the revenue-neutral rate. This will mean significant cuts to the budget and may impact some services. If you want to learn more details about what this means, the UG published an article explaining the 2025 budget and what revenue neutral means for the county and city.

Johnson County, Kansas

Although Johnson County exceeded the revenue neutral rate, it decreased the tax levy by .25 million. The county boasts on its website about having the “lowest rate among the state’s 105 counties for several years.” In other words, your property taxes may go up depending on any changes in appraised value, but overall tax rates should decrease slightly.

Leavenworth County, Kansas

The 2025 Leavenworth County budget exceeded the revenue-neutral rate. During a hearing on 28 August 2024, the Board of Leavenworth County Commissioners approved exceeding the revenue neutral rate. For other information regarding Leavenworth County property taxes, visit the county website.

Miami County, Kansas

Miami County proposed exceeding the revenue-neutral rate for the 2025 budget, but we couldn’t find much information. Please contact the county for more information.

Impacts on Your Financial Security

Nobody likes more taxes, and everyone likes a nice refund. However, inflation affects many retirees differently, and property taxes are no exception.

If you’re able to qualify for one of these programs, you might be able to stabilize your rising property tax costs. Keep an eye on changes to programs and eligibility requirements. Who knows, maybe there will be more new programs on the horizon.

Challenges with the Property Tax Relief Programs

One of the most significant issues with Kansas property tax relief programs is understanding which one is which and determining which one is best. Hopefully, the information here helps to alleviate some of the confusion. You’ll also need to make sure your taxes are filed correctly and on time so you can confirm whether you’re eligible for these programs.

Make sure to work with your accountant early to get your income taxes filed. You don’t want to wait until the last minute to file taxes and request these property tax refunds.

Can you ace this basic tax literacy quiz? See what you know & don't know (& why it matters).

How NextGen Wealth Helps with the Property Tax Freeze

Earlier this year, we sent information in our weekly newsletter (you can subscribe here) and notified our clients. For many of our clients, this tax freeze doesn’t dramatically change their lives but helps control a variable in their financial plans. Regardless, there’s no need to miss out on potentially significant future tax savings.

Whether you’re wondering how to save money on taxes or are looking to build your retirement plan, we’ve got you covered. Contact us today to see if we’re a good fit for you and get your free financial assessment!