Tax Hints from Warren Buffett’s Charitable Giving

Warren Buffett is one of the greatest investors and philanthropists of all time. What can we learn from his charitable giving, and how can we apply it to our own giving strategies?

The main point of charitable giving is making the biggest impact. However, when we plan our giving carefully, we can save on taxes and put even more money to good use. There are many considerations, such as when, how much, and which charities and causes to support.

Table of Contents

Understanding Warren Buffett’s Charitable Giving

First, it’s important to understand Warren Buffett's life goals and giving strategy. Luckily, his pledge letter on his website, The Giving Pledge, gives us direct insight into his philosophy.

To paraphrase, Warren believes he’s been incredibly fortunate in life. All his needs, wants, and desires are paid for, and everything else should go to a worthy cause. He pledged in 2006 to give away nearly all of his wealth, and he’s also encouraged other ultra-wealthy people to do so as well.

This is an interesting and humble way for him to perceive his great fortune. As of 2024, his net worth is an estimated $136 billion. He’s pledged to give away 99% of his wealth. We also think we could live off 1% of $136 Billion. How about you?

Major Contributions and Recipients

Warren Buffett tends to give in large chunks each year. For instance, he donated about $541.5 Million in Berkshire Hathaway Class B shares to the Susan Thompson Buffett Foundation, which he established to manage his charitable giving and later named after his late wife, Susan.

Buffett has also donated substantial amounts to other foundations. For instance, it’s reported that he’s donated over $39 billion to the Bill and Melinda Gates Foundation and more than $51 billion in total since 2006. He’s also stated that he’s leaving most of his wealth to other causes in his will.

Key Giving Strategies Used by Warren Buffett

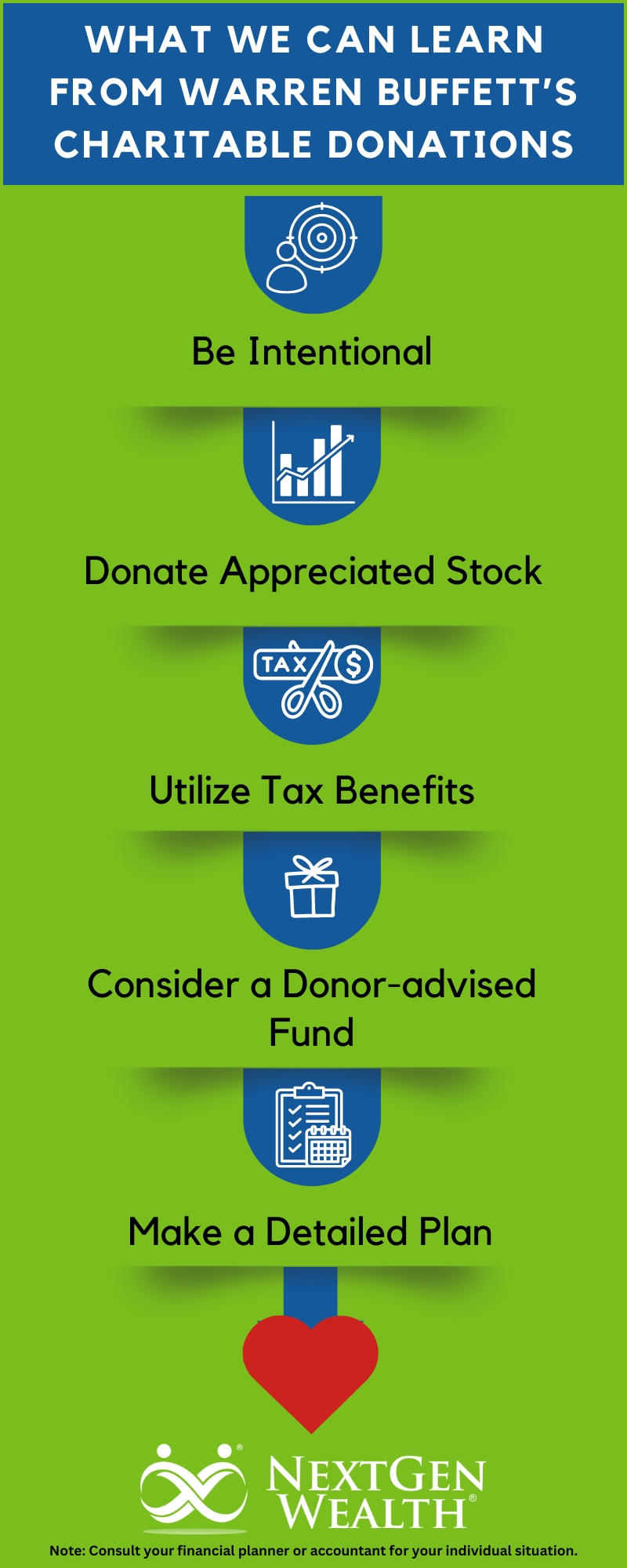

So, what can we learn from Warren Buffett’s charitable giving? We think there are a few key things: understanding your needs and values, planning ahead of time, and tax efficiency.

Clarity of Values in Charitable Giving

Warren Buffett is clear and realistic about what his wealth can and can’t do for him. He states that all his needs and desires are fulfilled, including his children's. He’s also communicated his desire to give now and continue through the ten years after his death.

The things he says his money can’t buy him are time, health, or other things he truly values. His pledge letter is very well-written and makes the point clear. He’s got all he wants in life, and therefore, the money is of little use to him.

Reaching this point in life is probably a better goal for anyone than accumulating wealth. Understanding and defining what “enough” means for everyone is really important.

Having a Deliberate Plan

Warren Buffett has a thought-out plan and has laid the framework to carry it out. You can tell there’s a plan by statements like “annually distribute about 4%” and “expended….by ten years after my estate is settled.” He mentions his will, the execution of his will, and the desire for it to go toward current needs.

Even from what little is publicly available, there's little doubt about his plans and intentions. More importantly, his family knows the plan, too. Not only has he planned his charitable giving, but he’s also communicated the plan and how it will be executed.

We’re a financial planning firm, so we’re slightly biased toward planning. However, we believe planning like this is important because we can see the benefits now and later. Having all your estate planning thoughtfully prepared for execution is truly a gift to those you leave behind.

Tax Efficiency: Donating Appreciated Stock

One key piece of information is what Warren Buffett donates: Berkshire Hathaway Class B shares. Donating appreciated securities (shares of stock with increased value) is a terrific way to donate more overall value while paying less taxes. But how does this work?

In general, when you donate appreciated securities (stocks and bonds) held for more than one year, you can deduct the stock's full fair market value (FMV). However, you won’t pay taxes on the amount donated. If you’d sold the shares instead, you could have paid as much as 23.8% tax (20% long-term capital gains tax + 3.8 Net Investment Income Tax).

This is a huge benefit to Warren Buffett because most of his wealth is in his shares of Berkshire Hathaway stock. You might be wondering why Class B shares and not Class A shares. In short, this is probably for two reasons: Class A shares have more voting rights attached to them, and the price of 1 Class A share is over $600,000 right now.

Practical Tax Hints Inspired by Buffett’s Strategies

We can glean many different “hints” from Warren Buffett’s charitable giving. Remember, with billions of dollars, things are certainly different than they would be for us “normal” folks. However, there are many things we can apply no matter what our level of wealth.

What to Donate

As mentioned above, Buffett donates appreciated shares of his company, Berkshire Hathaway. However, this strategy isn’t limited to Warren Buffett. You can also donate appreciated securities.

This could be a great option if you have a large amount of money in a taxable brokerage account. You’ll have to weigh the pros and cons, but this method can help you donate a higher-value item (which the charity can convert to cash) and pay less taxes.

Where to Donate

Warren Buffett donates his wealth to foundations and charities, like his own, which qualify under the 50% rule. This rule allows him to deduct up to 50% of his adjusted gross income and applies to anyone who itemizes their deductions. In general, individuals may be able to deduct up to 60% of AGI, but there are further limits based on the type of organization.

There are many different rules, but a charity should be able to tell you which AGI limit their charity qualifies under (50%, 30%, etc.). Double-check with your accountant on these. For Warren Buffett, it makes sense for him to establish his charity and donate to it directly, but there are other options, like donor-advised funds, which anyone can take advantage of.

Donor-advised Funds

Donor-advised funds are another great option for regular charitable contributions. A Donor donor-advised fund (DAF) lets you donate now, claim a deduction, and then direct where to use those funds later. Donor-advised funds also generally meet the criteria to be considered a public charitable contribution and meet the 50% rule.

Bunching of Charitable Contributions

Another benefit of a donor-advised fund is you can make a large donation in one year and use more of the tax deduction. For instance, if your giving is high enough, it may be better to itemize deductions. This “bunching” of deductions allows you to take advantage by itemizing one year and taking the standard deduction another year.

Bunching isn’t limited to using a donor-advised fund. This strategy could also work with other tax-saving strategies, such as directly contributing to charity.

How NextGen Wealth Can Help

You can get many insights from Warren Buffett’s charitable giving if you're charitably inclined. If donating to charity isn’t your preference, then employing these strategies probably doesn’t make sense. For the right person, tax-efficient charitable giving is a great option.

If charitable giving is in your plans, don’t wait to start mapping out the most efficient way to accomplish it. All your goals need to be incorporated into your overall financial plan. Saving on taxes isn’t the main point of donating to charity, but it has its benefits.

At NextGen Wealth, we can help you see the impact your giving may (or may not) have on your financial plan. We can help you evaluate your situation so you can sleep well at night, knowing you can contribute to causes you care about and still live the retirement lifestyle you’ve always dreamed of. Contact us today to see if you’re a good fit for us and schedule your free financial assessment!