The Widow's Penalty and How to Avoid It

This post was last updated on January 16, 2025, to reflect all updated information and best serve your needs.

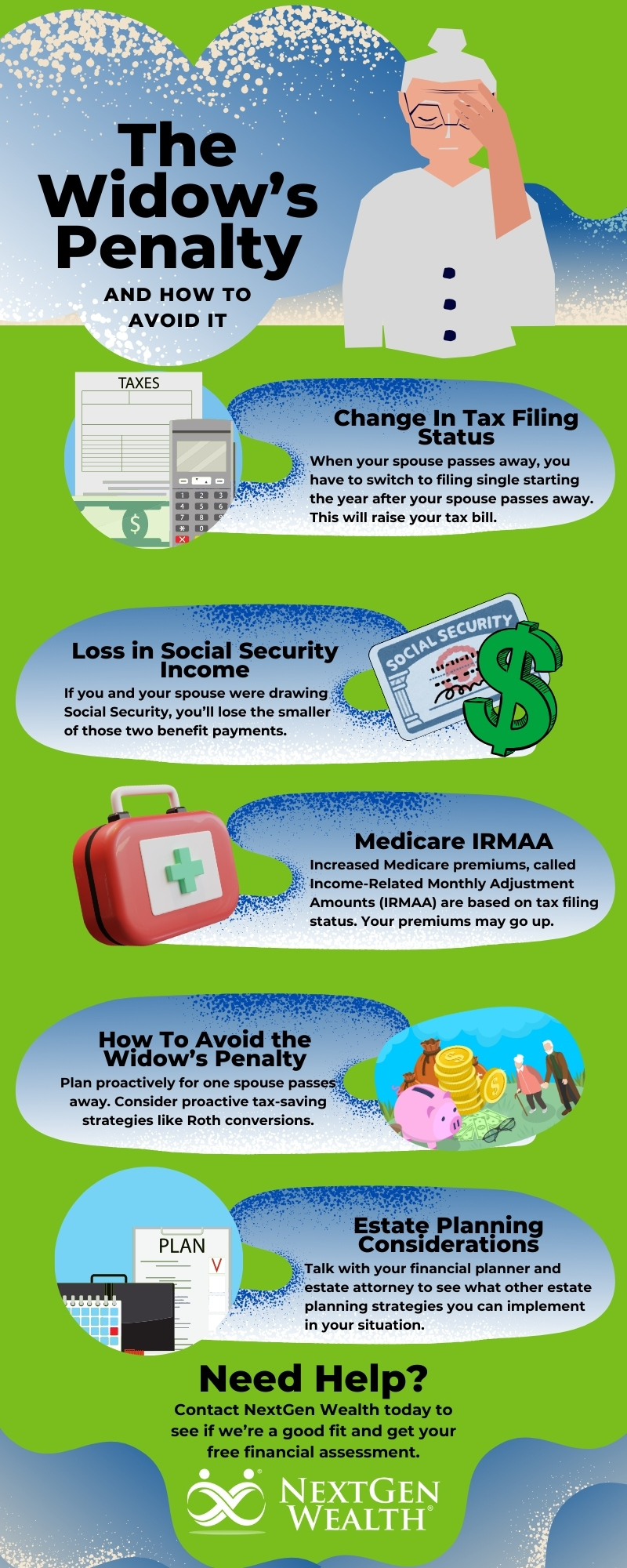

Losing a spouse is awful, and getting hit with a larger tax bill only makes things worse. Thinking about death is never fun, but failure to plan could mean serious tax issues for a surviving spouse. This is what’s often called the “widow’s penalty.”

Married couples enjoy many tax benefits, including higher thresholds for marginal tax brackets and higher standard deductibles. When one spouse dies, there may be some changes to income, but there likely won’t be as large of a change in living expenses.

Table of Contents

Understanding the Widow's Penalty

The widow’s penalty often refers to the collective effect of “halving” your income tax brackets and a potential reduction in other pay and benefits. In other words, when you file as married filing jointly, more of your money is taxed at lower tax brackets than when you file as single.

When your spouse passes away, you must switch to filing single starting the year after (unless you remarry). For instance, if your spouse passed away in January 2024, you could file as married filing jointly for the 2024 tax year, but you must start filing single for tax year 2025.

If one or both of you were drawing Social Security, you’d also lose some Social Security income. You might even end up paying more taxes on less income overall. This can be a really ugly situation.

Impact on Tax Liability

For example, if your annual taxable retirement income as a couple is $60,000 ($5,000/month), none of your income reaches the 22% tax bracket ($96,951 for married couples filing jointly). However, when one spouse passes away, you’ll have to start filing single, and the same income will reach the 22% tax bracket ($48,476 filing single).

You’ll also have a much smaller standard deduction. For 2025, the standard deduction for married filing jointly is $30,000 versus $15,000 for filing single. Overall, this could mean a significantly higher tax bill.

Marginal tax brackets are different from your effective tax rate. You won’t see a 10% increase on all your income taxes, just on the income above the cutoff for the next higher tax brackets. You may have more taxable income than before with the lower standard deduction.

But What About the Exception for a Qualifying Widow(er)?

You may have read about an exception that allows you to continue filing your taxes as married filing jointly. There’s a limited exception for a qualifying surviving spouse. However, you must meet specific criteria, and the exception is limited to the two tax years following your spouse's death.

In short, you must have been eligible to file jointly, have qualifying dependent children, and not be remarried. Check with your financial planner and coordinate with your accountant to see if you qualify. However, most retirees don’t meet the criteria.

Loss in Social Security Income

In Addition to smaller tax brackets, you may end up with less income as well. For instance, if both spouses were drawing Social Security, you’ll lose the smaller of those two benefit payments. Granted, your expenses may be slightly lower (one less vehicle needed, one cell phone, etc.).

However, the big expenses are unlikely to change. Your mortgage or property taxes won’t change, and your utility bills will be roughly the same, too.

In addition to losing one Social Security check, you could end up having more of it taxed. This is just another disadvantage of moving to a filing single status.

Common Situations Affecting the Widow’s Penalty

Some situations can make the widow’s penalty even worse. For instance, a large traditional (non-Roth) retirement account balance will eventually be subject to required minimum distributions (RMDs). If so, RMDs can affect the surviving spouse much more when you’re filing single.

The total RMD amount won’t change much and might even increase depending on the calculated life expectancy of the surviving spouse. Regardless, your entire traditional 401k or other traditional retirement account balance would still be subject to RMDs, making proactive tax planning even more important.

Medicare Income-Related Monthly Adjustment Amounts (IRMAA)

Another potential issue for widows and widowers is the potential for increased Medicare premiums. This is because the Income-Related Monthly Adjustment Amounts (IRMAA) are based on filing status. If you have to start filing single, your premiums could increase.

However, you can ask to have your IRMAA lowered for a life-changing event like a spouse's death. Your premiums are based on your modified adjusted gross income (MAGI) from two years prior. Since you had a life-changing event, you can request an adjustment.

Long-Term Financial Planning for Couples

We always suggest you plan for your retirement—not just next tax season. It’s impossible to know exactly what will happen, but you can think through some worst-case scenarios. Doing these “stress tests” also ensures you don’t run out of money or end up in a tax mess.

Depending on what you discover, you can start making changes and implementing tax-saving strategies now. You can’t prevent every problem but you can reduce the most severe issues from derailing your retirement.

Optimizing the Tax Posture of Retirement Savings and Investments

You’ll want to start positioning retirement savings to reduce the risk of the widow’s penalty – or decrease how severe it is. One way of doing this is to have lower taxable income in retirement. But how do you do that?

Creating a Comprehensive Financial Plan

As mentioned, you want to run through scenarios to see what issues may arise. Then, you can adjust your financial plan accordingly. Think of it as a playbook for the current situation and how you’ll operate throughout retirement.

A great financial plan covers many different life changes and market conditions. You want to get ahead of issues. Don’t be caught by surprise.

Tax Planning to Mitigate the Widow's Penalty

Luckily, there’s still plenty you can do to prepare for the widow’s penalty. Ideally, you want to start implementing tax strategies before something happens. Being proactive is definitely better in this case.

One way to plan is to convert some of your retirement savings into a Roth IRA. You can do this through Roth IRA conversions.

How Roth Conversions Help

Roth conversions allow you to transfer money from your traditional account, like your 401k into your Roth IRA. In essence, you’re prepaying taxes on future retirement income. You’ll pay taxes on the money you convert to Roth now, but you can withdraw the Roth balance (including gains) later without paying taxes or being subject to RMDs.

Qualifying withdrawals from Roth accounts are not included in your income. This can help you pay for living expenses without raising your income in retirement. Although your tax bill will increase now, it will be significantly lower throughout your lifetime.

It may not be practical to convert all of your traditional IRAs to Roth. However, getting your estimated RMDs to be equal to or less than your expenses will help a lot.

Estate Planning Considerations

There may even be some ways you can proactively move money to soften the widow’s penalty. If you’re charitably inclined, you could start making qualified charitable contributions (QCDs) starting when you’re 70-1/2.

There may be other estate planning strategies you can implement as well. Talk with your financial planner and estate attorney to see what you can do.

Seeking Professional Advice and Support

Death is an unfortunate part of life we all have to face. With professional guidance, you can mitigate most of the financial effects of the widow’s penalty. We’re never excited about these conversations, but you’ll be glad you planned for everything.

At NextGen Wealth, we regularly evaluate your tax situation and plan for all scenarios, including the widow’s penalty. Don’t wait until something happens. Contact us today to see if we’re a good fit and get your free financial assessment.