Building Multiple Streams of Retirement Income

Savvy retirees know the importance of having multiple streams of income in retirement. Multiple income sources help ensure financial stability and peace of mind. We know the importance of having a diversified portfolio, but diverse income streams are even better!

You don’t want all your nest egg(s) in one basket. It’s best to analyze all potential income sources first thoroughly. Then, you can craft a comprehensive financial plan to meet all your retirement needs.

Table of Contents

Understanding the Need for Multiple Income Streams

Why do you need multiple income streams? You probably already have a couple of retirement income streams with your 401(k) and Social Security. Very few people have ever been upset they had more sources of income.

When retirement income comes in from several sources, you can weather recessions and down markets, implement strategies to maximize tax savings, fight against inflation, and reduce the risk of outliving your money.

Longevity Risk

Longevity risk is simply the risk of outliving your money. In other words, how do you avoid running out of money if you live longer than expected? This can be tricky, but if you plan carefully, you can mitigate this.

You’ll want to optimize income streams like Social Security, which lasts your lifetime. Some pensions and other annuity-style income streams could also help fight this risk. The bottom line is you want to ensure you’re covered no matter how long you live.

Worried if you're going to have enough income to retire? Learn more here.

Inflation and Rising Costs

Multiple income streams can also help with the risk of inflation eating away at your purchasing power. Some income streams, like a properly diversified portfolio, can help keep up with the effects of inflation. Social Security does this to an extent as well.

However, your individual expenses may rise faster than the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the basis for annual Social Security cost-of-living adjustments.

Market Volatility

If you’re unlucky enough to retire in a worse-than-expected market environment, relying solely on investments might be tricky. This is what we refer to as the sequence of return risk. We can still adjust for this, but having a solid base from other income sources can help immensely.

We always plan for market volatility regardless of what anyone thinks might happen. We know the market trends upward over time, but it’s not a perfectly straight line. There are ups and downs along the way.

Traditional Sources of Retirement Income

There are many different options to build your total retirement income strategy. The primary income sources include Social Security, investment income (401k, IRA, etc.), pension income, annuities, and other assets like real estate income.

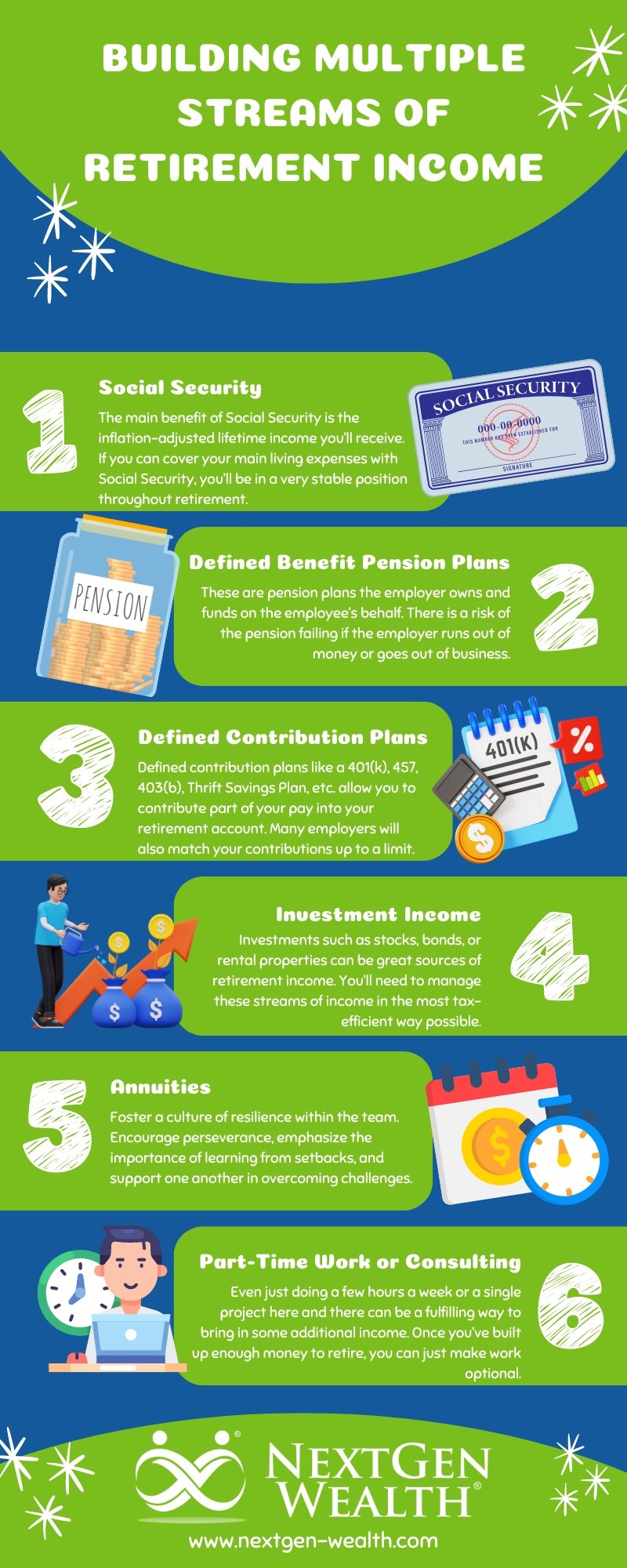

Social Security

Social Security benefits are a major source of income for many retirees today. The main benefit of Social Security is the inflation-adjusted lifetime income you’ll receive. If you can cover your main living expenses with Social Security, you’ll be stable throughout retirement.

You should consider maximizing your Social Security payout. This can significantly reduce the longevity risk we mentioned earlier.

Pension Plan Income

The news would have you believe there aren’t any pension plans left. If you’re subscribed to our newsletter, you already know our opinion of the news. There are fewer defined benefit plans than there once were, but they’re certainly not a thing of the past.

In fact, there has even been recent news about IBM switching back to a type of defined benefit plan. This doesn’t mean all companies will do the same, but it seems to refute the myth that defined benefit plans are extinct.

Defined Benefit vs. Defined Contribution Plans

Defined benefit pension plans are generally what people are referring to when they say they have a “pension” plan. These are pension plans the employer owns and funds on the employee’s behalf. There is a risk of the pension failing if the employer runs out of money or goes out of business.

However, the Pension Benefit Guarantee Corporation (PBGC) insures against this. The payout may be lower, but you have some protection. Many protections are in place to ensure the pension doesn’t fail, but if the company goes bankrupt, there may not be many other options.

You'll see some of the most common pensions with federal, state, and local governments. Many unions still offer defined-benefit pensions, and some larger companies still offer pensions.

Regardless, if you have access to a pension, it’s really important to understand your pension payout options and make a plan to maximize your benefits.

Defined Contribution Plans

Most smaller and many larger employers offer a defined-contribution plan like a 401(k). In some cases, you may be eligible for both. You can contribute a portion of your pay into your retirement account with a defined contribution plan. Many employers will also match your contributions up to a certain percentage of your income you defer.

This money is invested in the market. Over time, the money grows, and then you can convert the lump sum you’ve accumulated into an income stream when you retire.

Worried that you might run out of money in retirement? Learn more here.

Investment Income

Investments such as your 401(k), IRA, taxable brokerage accounts, or rental properties can be excellent sources of retirement income. You’ll need to manage these different streams of income to produce income from them in the most tax-efficient way possible.

A diversified portfolio of stocks, bonds, index funds, and mutual funds is a great way to keep up with inflation. In many cases, retirees may end up with more in their retirement accounts when they pass away than when they entered retirement.

Having several non-correlated assets is essential to ensure you can weather any market downturns. For instance, a portfolio of bonds will continue to generate income via coupon payments regardless of their underlying value or what the stock market is doing. Also, bond prices tend to move much less than stocks and fluctuate with interest rates rather than economic business cycles.

Real Estate Investments

Rental income can be another stream of income in retirement. Some people even build quite sizable rental portfolios. Rental income can be a great way to supplement your other income streams.

Rental properties aren’t always a walk in the park. There are maintenance costs, vacancies, and damage to properties over time. However, many choose to utilize a property management company to help deal with these problems.

Real estate can often have unique tax advantages, too. It's best to analyze properties carefully though. The wrong property could result in more headaches than it’s worth.

There are even alternative investments built with rental properties. Real Estate Investment Trusts (REITs) are becoming a popular way to invest in real estate. In their simplest form, REITs use their investors’ money to purchase and manage real estate investment properties. Then, the REIT shares the profits with the individual investors.

Annuities

Annuities are a type of insurance product. Think about an annuity as a type of insurance against outliving your money. An annuity may be a good option if you need more guaranteed income than your pension and Social Security can generate.

An annuity is a contract between you and an insurance company to provide you with income. In exchange, you pay a fee for the annuity. An insurance company can do this because they invest your money and spread the risk across many individuals.

Insurance companies employ teams of actuaries to determine how long a particular pool of individuals will live on average. Then, they calculate their estimated payouts, build a profit margin, and sell the annuity to you.

Annuities are complex products that should be carefully considered before agreeing to purchase. It’s always best to first engage a fiduciary like a Certified Financial Planner Professional (CFP®).

Part-Time Work or Consulting

Another potential income stream is working part-time. Many of us enjoy what we do, so the thought of never doing it again doesn’t sit well. The good thing is you can “retire” without fully retiring.

Even just doing a few hours a week or a single project here and there can be a fulfilling way to bring in some additional income. Once you’ve made enough money to retire, you can make work optional. In other words, you get to choose your adventure.

Creating Your Retirement Income Plan

No rule says you need a certain number of retirement income sources. However, having more than one income stream can give you great confidence and peace of mind. Ensuring you have enough income to accomplish your goals is the most important thing.

If you have an income gap, you may want to revisit your plan and adjust it. If you start working with a financial planner early, you can make critical adjustments during your working years to make retirement go more smoothly.

Final Thoughts on Having Multiple Retirement Income Sources

You’ve probably been building multiple income streams and didn’t even realize it. If you’ve been saving for retirement, you probably have at least two sources of income between your investments and Social Security. You may or may not need to build additional income sources.

You may need to analyze and employ some tax-saving strategies to “tie a bow” on your retirement income streams. The good thing is you’re not the first to cross this bridge.

How NextGen Wealth Can Help You

We believe a financial plan should be built around you—not the other way around. We analyze your current situation, and if we’re a good fit to work together, we’ll walk you through our COLLAB Financial Planning Process™ to craft a personalized financial plan.

Contact us today to learn more about what it looks like to work with us and see if we’re a good fit for each other.