Expert Strategies to Pay for Your Grandchild's College

There’s no denying the importance of getting a quality education. However, the rising cost of higher education really makes things difficult for young families. It’s not uncommon for grandparents to want to help their grandchildren pay for college.

With that being the case, there are some key strategies for you to help your grandchildren without affecting their chances for student aid. You can probably save some taxes too – if you know what to do.

Start Early: Establishing a Solid Foundation

Like your retirement investment journey, it’s never too early to start saving for education. Investing money early will make saving for your grandchild’s education easier.

We really want to emphasize the benefits of planning early. Whether you’re using a savings account, savings bonds, or a 529 plan, letting time compound the investments is always best. If you’re using a trust to help with funding college, or as a part of your overall estate plan, then getting your trust(s) established and funded early saves a lot of time and hassle later on.

Leveraging Tax-Advantaged Accounts

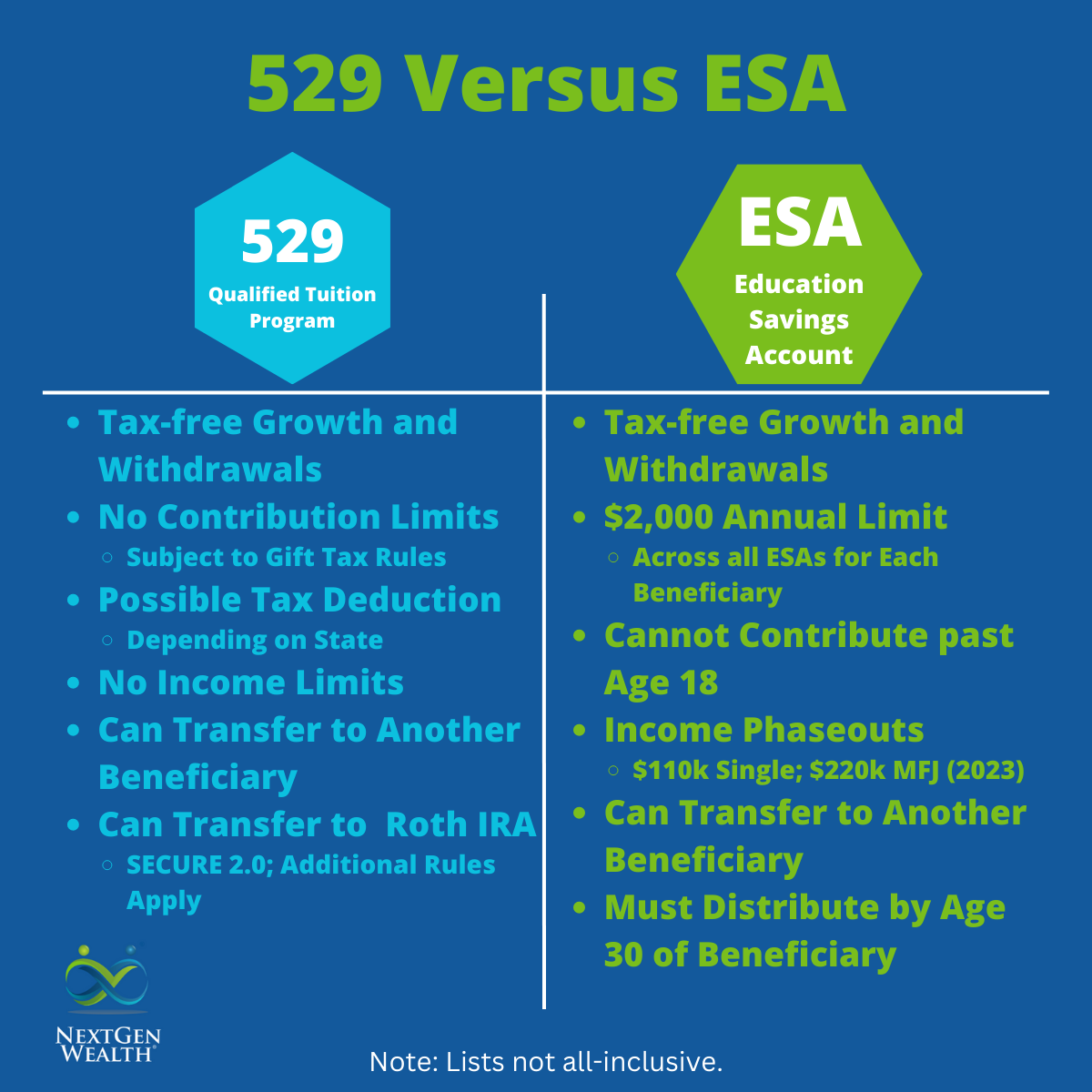

529 plans and Coverdell Education Savings Accounts (ESAs) have many advantages. These accounts offer many tax advantages, as well.

Qualified Tuition Program (QTP) – 529 Accounts

The term the IRS uses is Qualified Tuition Program (QTP), but they are called 529 plans by almost everyone (including financial institutions who manage them). The biggest benefit is the ability to contribute money after tax then pull the money out tax-free for education expenses. This means you won’t get taxed on the account's growth as long as you use the money for qualified expenses.

Another neat feature is many states offer a tax deduction for contributions to a 529 – including Missouri and Kansas. Unfortunately, there isn’t a federal tax deduction.

The SECURE Act 2.0 also added the ability to transfer money in a 529 to a Roth IRA for the beneficiary. There is a lifetime limit of $35,000, subject to annual contribution limits, and the account must have been in the beneficiary’s name for at least 15 years. In other words, do your research and plan early.

The main benefit of a 529 is the tax-free growth. You can invest the money in the 529 like you would a Roth 401k or Roth IRA. The money goes in after-tax (but you do get a state tax deduction in many states including Missouri and Kansas), grows tax-free, and then is withdrawn tax-free for qualified education expenses – pretty sweet!

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts, or simply ESAs, work slightly differently than a 529. The biggest differences are the income limits and contribution limits for ESAs. You can only contribute up to $2,000 per year per beneficiary across all ESAs in their name.

However, you can contribute to an ESA and a 529 in the same year for the same grandchild (beneficiary). There are no tax deductions for contributions to an ESA. You are subject to income limits for ESAs. If your modified adjusted gross income (MAGI) is $110,000 ($220,000 if filing a joint return) or more, you may not contribute to an ESA.

Distributions from an ESA

The funds are tax-free as long as distributions from the ESA are for qualifying education expenses. However, you can’t “double dip” with a 529, an ESA, or certain tax credits. You can only get the tax-free treatment for up to the total amount of qualified expenses.

All funds in an ESA must be withdrawn by the designated beneficiary’s 30th birthday. Distributions solely for this reason will be taxed on the portion of earnings. However, you may be able to change the beneficiary to another relative instead.

Gift and Estate Planning Strategies

There are some gift and estate tax considerations when contributing to college funds. You wouldn’t want to create an extra tax burden while trying to save on taxes. This would defeat the purpose of trying to save on taxes by using those accounts.

Utilizing Annual Gift Tax Exclusions

Generally, a contribution or gift to any family member, especially grandchildren, is considered a gift. However, you have an annual and lifetime exemption for gifting. The current annual gift tax exclusion is $17,000 ($34,000 if you do split gifting) for 2023.

This means you can contribute up to $17,000 without any gift tax consequences. You can also contribute up to 5 years’ worth and claim the exemption for the next 5 years. This may be helpful if you’re trying to save for college fast, but there’s some risk and complexity.

Incorporating Educational Expenses into Your Estate

When you’re planning for an efficient wealth transfer, you might consider other options like trusts. You could utilize a trust to pay for college expenses so the unused money can be utilized for other things. We’re not going to touch on all the specifics. Contact your estate attorney for more information on how to properly establish and fund a trust for this purpose.

Other Strategies

There are many other ways you could help pay for your grandchildren’s college. Here are some of those options.

Paying Tuition Directly

Paying your grandchild’s tuition directly is a great way to help out. Amounts paid directly to a qualifying institution for tuition are not considered gifts. However, it is important to understand this is for tuition only – not for books, equipment, or living expenses.

This can be especially helpful for the later years of college when other sources of aid and scholarships have run out. Also, this might be a real help if they decide to move on to graduate programs.

Paying tuition directly doesn’t get the same tax benefits as a 529 or ESA, but if your grandchild is already in school, those aren’t really going to have a chance to get the benefits of tax-free growth anyway. Actually, you can’t contribute to an ESA once your grandchild is 18, regardless.

Paying Off Student Loans

Another option is helping to pay your grandchild’s student loans. You might not have been able to help when they started college, but you can help now. You can call it your very own “grandparent student loan repayment program” if you’d like.

No special tax treatment exists for this, and you’re still subject to annual gift tax exclusion amounts.

Using Your IRA or Roth IRA

Although we don’t necessarily recommend using retirement funds, you could use your IRA to help pay for college. You can even take a distribution before age 59-1/2 and avoid the 10% penalty if the withdrawal is for education costs – including your grandchild or your spouse’s grandchild. Once again, this probably isn’t ideal – at least not for everyone.

Key Considerations for Maintaining Student Aid Eligibility

One of the final, yet very critical things to consider is making sure you don’t hinder your grandchild’s ability to get student aid. There are many things to consider here, so we can’t cover them all. One of the biggest things to watch for is anything which would affect the expected family contribution (EFC).

There are a few different ways to arrive at the expected family contribution (EFC). The EFC is a government term for how much the family should “reasonably” be able to pay for college. This is subtracted from the public institution’s cost to help determine how much aid, if any, is necessary.

Private institutions may calculate this differently and may have other programs, grants, and scholarships available. You really have to get into the weeds on this.

Generally, the EFC is determined by a combination of the parents’ and the student’s available income and asset contributions. The key point here is there’s no inclusion of income or assets held by a grandparent vs a parent or the student themselves.

In other words, you wouldn’t want to give cash directly to your child or grandchild. Also, until recently, any tuition you pay directly from a 529 you own would be counted as non-taxable income to the student – reducing their student aid eligibility.

With the Consolidated Appropriations Act of 2021, there are some immediate and future changes to how student aid is calculated. The main thing to note is that your contributions and subsequent tuition payments are no longer included in the student’s income. So, for now, use a 529 or ESA as a pass-through to ensure your grandchild’s student aid isn’t affected.

Communication and Planning are Key

No matter what, it’s always best to work in concert with your children and grandchildren. You want to make sure everyone is on the same page. As we mentioned before, planning early can be a huge benefit – especially when utilizing your annual gift tax exemptions. We want you to be able to get maximum growth, tax savings, and aid to your grandchildren.