Important Deadlines as You Retire

As you draw closer to retirement, it’s essential for you to get things filed on time. In many cases, you’ll only have one opportunity to get things right. Other decisions may lock you in for a long time.

No matter what, each decision and deadline as you approach your retirement date is critical. This is why NextGen Wealth specializes in the transition phase of retirement and beyond. If you take the time to lay the foundation of your retirement on solid ground, everything else goes much more smoothly.

Table of Contents

Social Security and Medicare Deadlines

Social Security and Medicare are two of the most important benefits to retirees across the United States. You’ve been paying into these programs your entire working career, so you may as well get the most you can from them.

Understanding Social Security Eligibility

Just because you’re eligible to draw Social Security early doesn’t mean you should. Deciding on the best Social Security withdrawal strategy is a major decision because you can’t go back and change it later. However, it’s not always a straightforward answer on when to start drawing.

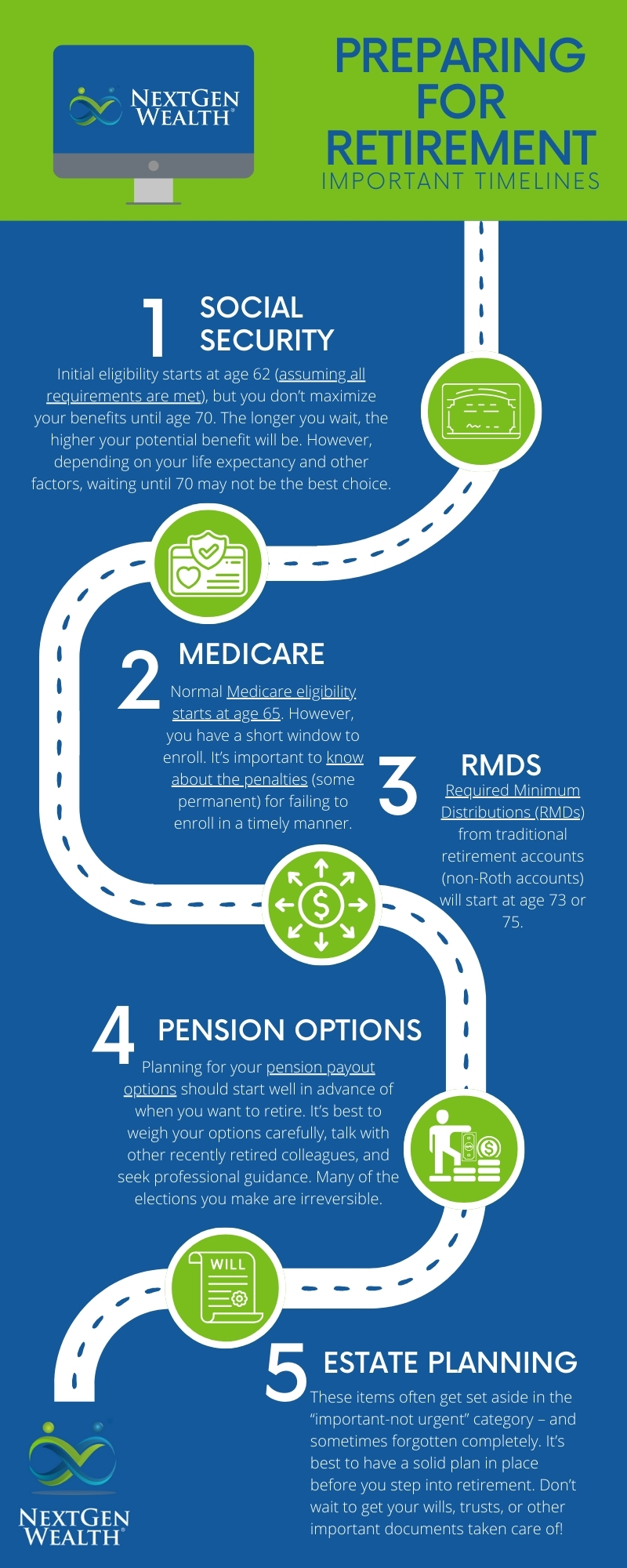

Initial eligibility starts at age 62 (assuming all requirements are met), but you don’t maximize your benefits until age 70. The longer you wait, the higher your potential benefit will be. Depending on your life expectancy and other factors, waiting until 70 may not be the best choice either.

If you’re married, it may be better for one spouse to draw Social Security earlier or later than the other. You may also end up with a scenario where it makes sense for one spouse to draw earlier and the other one to wait past full retirement age. In reality, the fine details of your financial situation will determine the best Social Security withdrawal strategy for you.

Medicare Enrollment and Initial Coverage Decisions

Normal Medicare eligibility starts at age 65. However, you have a short window to enroll (exceptions may apply). It’s important to know about the penalties (some permanent) for failing to enroll in a timely manner. Worse, these penalties increase the longer you wait to enroll!

Your initial enrollment period starts three months before the month you turn 65 and continues through the third month after you turn 65. In other words, if you turn 65 in June, your 7-month enrollment period is from March 1st through September 30th.

Navigating Medigap and Medicare Advantage Choices

Before enrolling in Medicare, you must also decide if you want a Medicare Supplement or “Medigap” policy or if a Medicare Advantage (Part C) plan is a good option. These can have significant impacts on the care you receive as well as your costs. Don’t wait until the last minute to consider if a Medicare Advantage or Medigap policy is right for you.

Pension and Retirement Account Deadlines

If you’ll be eligible for a pension, it’s imperative for you to know all the deadlines for your employer’s plan. Understanding eligibility rules and other ways to maximize your pension payout is also important.

Pension Options and Deadlines

Planning for your pension payout options should start well in advance of when you want to retire. It’s best to weigh your options carefully, talk with other recently retired colleagues, and seek professional guidance. Many of the elections you make are irreversible.

You’ll also want to nail down exactly when you must submit your retirement paperwork. Many plans require advance notice to prepare your transition and retirement benefits. Once again, a little bit of prior planning goes a long way here.

Creating a written timeline or a special retirement calendar may be worth it. Do whatever it takes to sort through the information and make the best decision for you.

Required Minimum Distributions (RMDs) from Retirement Accounts

You also need to plan for changes during your retirement too. With the changes in SECURE 2.0, your required minimum distributions (RMDs) from traditional retirement accounts (non-Roth accounts) will start at age 73 or 75. If most of your retirement savings are in your traditional 401k or IRA, this could have a significant impact on your taxes in retirement.

You may want to explore some tax-saving strategies which could affect other decisions you need to make. Bottom line is that RMDs can affect your retirement and create a tax burden – prepare accordingly.

Roth IRA Conversion Opportunities

There are many opportunities to save on taxes throughout retirement. However, some strategies, like Roth conversions, are best to plan and implement over time. The earlier you start, the more effective some of these strategies become.

In many cases, we help clients complete smaller Roth conversions over several years. This increases taxes a little today but can dramatically reduce your lifetime tax bill. In some cases, it could even be hundreds of thousands of dollars over your lifetime.

Legal and Estate Planning Deadlines

There aren’t really any fixed deadlines for your estate planning documents, but there’s no need to wait for an emergency to happen either. Estate planning items often get set aside in the “important-not urgent” category – and sometimes forgotten completely. It’s best to have a solid plan in place before you step into retirement.

For instance, if you have a need for life insurance but can’t qualify for affordable coverage, this could make a survivorship option on your pension more important. Survivorship options may also be unaffordable, but it’s best to know and check. This could in turn make looking into continuing or converting employer group life insurance more important.

Regardless, not planning for “the end of the plan” won’t stop it from happening. These are some choices you can’t go back to fix later. It’s best to confront these issues and make informed decisions now.

Creating or Updating Your Will and Living Will

The last thing anyone wants to do is leave in a whirlwind of confusion, pain, and heartache. Losing you will be hard enough without wondering if your wishes are being carried out. Having these tough conversations and forming the legal documents and framework to carry out your wishes is one of the best gifts you can leave behind.

Establishing a Power of Attorney and Healthcare Proxy

Proper legal documentation to carry out your medical wishes is more important than ever. With advanced technology, it’s possible your body could be kept alive for an extended amount of time – whether or not you are there mentally. This can create some exceedingly tough decisions and unnecessary financial strain for your family.

Each state has its own unique laws around advanced directives and medical power of attorney rules. Be sure to get professional guidance from a qualified estate attorney. Leave no room for doubt for your doctors or your loved ones.

Reviewing and Updating Beneficiary Designations

Even if you aren’t ready to update your estate documents, adding a transfer on death (TOD) or payable on death (POD) to your important assets and accounts can help dramatically. When your assets have proper TOD/POD designations, most of your estate can pass to heirs without going through probate.

Keep in mind that these are not a substitute for proper estate planning. They’re a great first step and useful tools. However, there are some things a TOD/POD designation just can’t do.

Building the Retirement Team

Overall, you’ll need to build your retirement plan and have a team to help make your retirement a homerun. You’re the star player, but getting solid advice and services from a financial planner, estate attorney, CPA, and other professionals will give you peace of mind.

More importantly, you’ll save yourself a whole lot of time, money, and heartache. Contact NextGen Wealth today for your free financial assessment and see how we can help you build your dream retirement.