Preparing Retirees for the TCJA Sunset in 2025

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly changed our tax landscape. However, most changes were temporary and set to expire or “sunset” at the end of 2025. This means some essential tax-saving tools may disappear.

In other words, time is running out to maximize particular tax savings – unless Congress takes action. We don’t know about you, but counting on Congress to do anything feels like a roll of the dice. We can take action now to set ourselves up for success regardless of what happens.

Table of Contents

- Understanding the Tax Cuts and Jobs Act: What Changes After 2025?

- Maximizing Tax Benefits While You Still Can

- Potential Risks to Acting “Early” on TCJA

- Roth Conversions: Should You Act Now?

- Reevaluating Your Income Strategies Pre-Sunset

- Reviewing Your Estate Plan Before Tax Exemptions Change

- Charitable Contributions and Gift Giving: Timing Giving for Maximum Impact

- Capital Gains Considerations Before the TCJA Expiration

- Required Minimum Distributions: Planning Ahead for Higher Tax Rates

- Seeking Professional Guidance to Navigate Changing Tax Laws

Understanding the Tax Cuts and Jobs Act: What Changes After 2025?

The Tax Cuts and Jobs Act (TCJA) includes many changes, but most are tied to income tax brackets, credits, and deductions. The number of marginal tax brackets and thresholds were overhauled, as were standard deductions. The estate and gift tax exemptions were also significantly increased.

What Happens in 2025?

We don’t know exactly what will happen to the current TCJA provisions set to expire on December 31st, 2025. There is a lot of uncertainty because there may be significant shifts in power from the 2024 election – at a minimum, we’ll have a different President of the United States. However, we can’t predict the future.

If nothing is done, many of the provisions from TCJA will revert to the former rules. However, many income bracket thresholds, credits, and deductions will be adjusted for inflation. We will have some estimates of what tax brackets might look like later in this article.

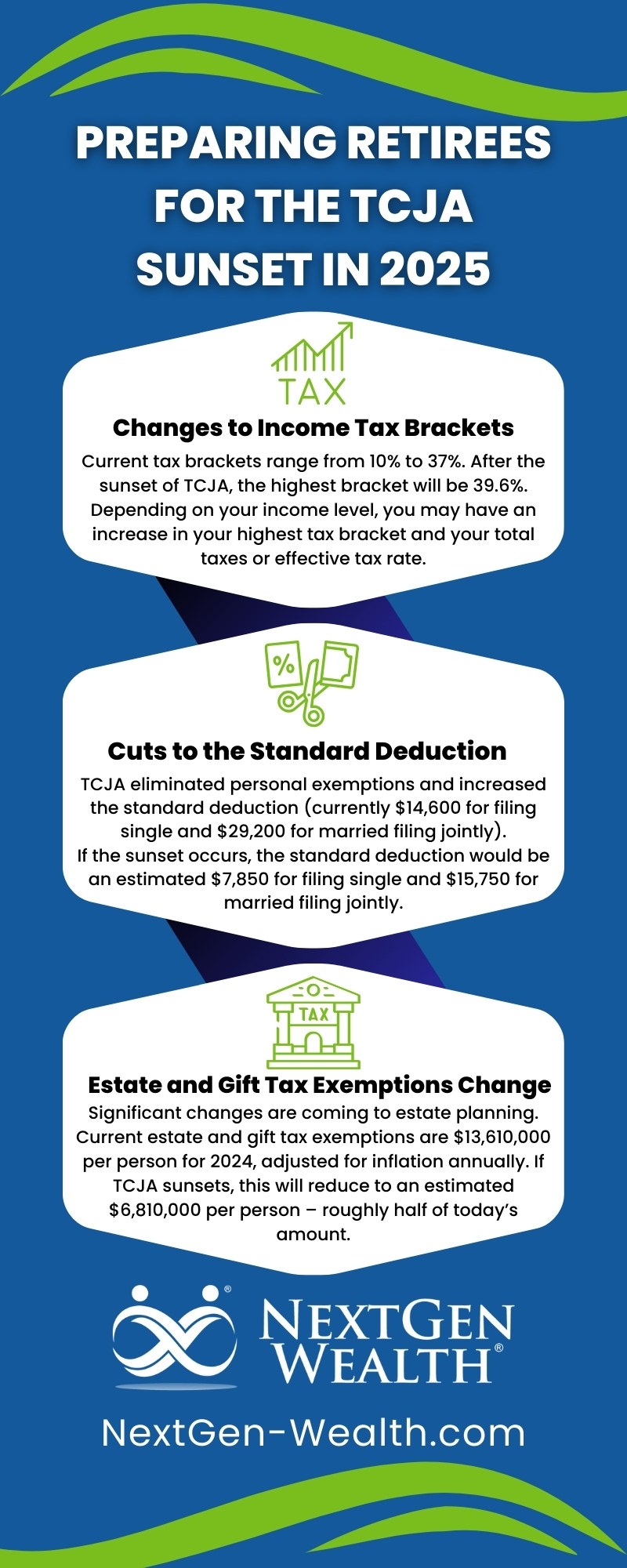

Changes to Income Tax Brackets

The tax code before the passing of the TCJA had seven income tax brackets ranging from 10% to 39.6%. In 2018, these were adjusted to be between 10% and 37%, and the threshold for the highest bracket was adjusted to be higher.

Depending on your income level, you may have an increase in your highest tax bracket and your total taxes or effective tax rate. For a complete comparison, download our free TJCA Comparison Guide below.

Cuts to the Standard Deduction

An often overlooked but significant change is the higher standard deduction. The TCJA eliminated personal exemptions and increased the standard deduction. After adjusting for inflation, the current standard deduction is $14,600 for filing single and $29,200 for married filing jointly.

If the sunset occurs, the standard deduction would be $7,850 for filing single and $15,750 for married filing jointly. However, you can add personal exemptions of $5,050 per person. So, for larger households, this could be more beneficial.

Changes the Decision to Itemize

We’ll discuss this later in the article, but the lower standard deduction might make itemizing your deductions more appealing. This could be an even more significant change if you own a small business.

Changes to Deductions and Credits

Speaking of small businesses, another significant change is the removal of the deduction for Qualified Business Income (QBI) (up to 20% of income or QBI). This could significantly impact some business owners.

However, if the TCJA sunsets, the limitation on state and local tax (SALT) deductions will be eliminated. For high-income earners, this could be a significant benefit.

Maximizing Tax Benefits While You Still Can

Many taxpayers' highest income bracket decreased after TCJA. Theoretically, this could mean your overall effective tax rate may be lower now than in 2026. But what if the TCJA is extended?

Potential Risks to Acting “Early” on TCJA

In reality, it seems both Republicans and Democrats are likely to keep things mostly the same for households with incomes under $400,000 annually—or at least this is what the current administration is using as a threshold. The TCJA was passed during the Republican “trifecta” majority in 2017, so they’re likely to keep much of the TCJA (if they take action in time).

In other words, there’s minimal risk to taking action now. And, possibly more importantly, you shouldn’t be too worried or stressed about it. We recommend taking action based on the best current information and not speculating too much. If you want to stay current, join our newsletter for market information and news you’ll enjoy reading.

Roth Conversions: Should You Act Now?

Roth conversions have been a critical strategy since required minimum distributions (RMDs) were introduced. We regularly evaluate and analyze whether Roth conversions make sense for our clients. In short, you can pay taxes now and enjoy tax-free growth later.

There may be specific times when Roth conversions could make even more sense. Some common examples are the years after retirement, before drawing Social Security, and during down markets. In other words, your situation plays a leading role in the timing of Roth conversions much more than the sunset of TCJA.

Reevaluating Your Income Strategies Pre-Sunset

Many retirees have multiple streams of income. Not all income is created equal and will be affected differently by changes to tax law. For instance, your pension or Social Security income might not be affected as much as a large traditional 401(k) balance.

If the TCJA sunsets, some potential changes will come to the ability to do “like-kind” exchanges. This provision, often called a 1031 exchange, could affect your real estate portfolio. With the recent spike in real estate values, you might also have lots of equity you should consider realizing now versus later.

Reviewing Your Estate Plan Before Tax Exemptions Change

Some significant changes are also coming to estate planning. The current estate and gift tax exemption is $13,610,000 per person for 2024. These amounts are adjusted for inflation annually. If nothing changes and TCJA sunsets, this will reduce to an estimated $6,810,000 per person – roughly half of today’s amount.

Keep in mind this is only for the federal side. The TCJA sunset wouldn’t change your state's estate tax limits. Regardless, you need to consider updating your estate plan and associated documents.

Charitable Contributions and Gift Giving: Timing Giving for Maximum Impact

If you’re charitably inclined, you want to ensure your money does the most good. Donating in a tax-efficient manner can help you achieve more of your goals. In this case, you might want to delay some charitable giving.

With the current higher standard deduction, strategies like bunching donations are more common. However, if the standard deduction is reduced, many more people will benefit from itemizing deductions. Therefore, you may want to donate on more of an annual basis versus making large contributions in some years and not others.

Gift Tax Considerations

As we mentioned, the gift tax may also be reduced. As far as we know, any gifting you complete now will not affect you later. So, if you have a large amount of assets you need to gift or move into a trust, now may be the time to do it. The bottom line is not to put off discussions around estate planning.

Capital Gains Considerations Before the TCJA Expiration

There’s one area where there’s almost no change – long-term capital gains tax rates for individuals. There could be changes since short-term capital gains are taxed at your marginal tax rates. Understanding how capital gains can push you into higher tax brackets is also important.

If you expect to be in a higher tax bracket after the TCJA sunsets, you may need to make some moves now. Looking into tax-gain harvesting or other strategies to realize those gains might be beneficial.

Required Minimum Distributions: Planning Ahead for Higher Tax Rates

If you’re headed toward RMDs, then the TCJA sunset could be a double whammy. If your tax rates go up and RMDs push you into a higher tax bracket, it would cause a mess. Now is the time to explore tax-saving strategies and analyze how you’ll be affected.

Seeking Professional Guidance to Navigate Changing Tax Laws

At NextGen Wealth, we monitor current changes for our clients. More importantly, we conduct in-depth analyses and planning to ensure our clients don’t miss out on opportunities to maximize their retirement.

In fact, we’ve created a valuable guide to help you determine if you’ll be affected by the TCJA sunset. This is the same helpful tool (among many others) we use to educate our clients on how the TCJA sunset affects them. You can download it here or click on any of the banners in this article.

Contact us today to see if we’re a good fit and schedule your free financial assessment. Start planning your retirement and take action to prepare for the TCJA sunset today!