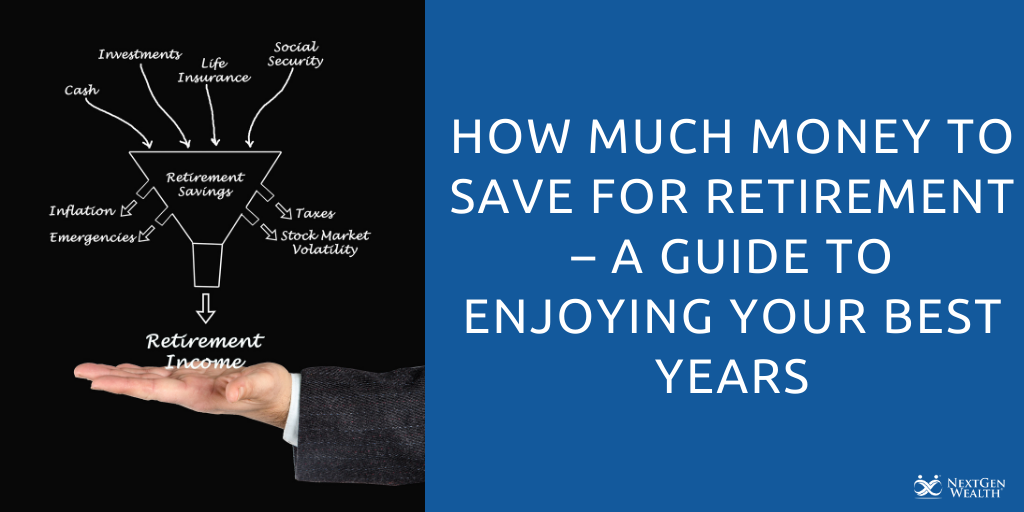

Savvy retirees know the importance of having multiple streams of income in retirement. Multiple income sources help ensure financial stability and peace of mind. We know the importance of having a diversified portfolio, but diverse income streams are even better!

You don’t want all your nest egg(s) in one basket. It’s best to analyze all potential income sources first thoroughly. Then, you can craft a comprehensive financial plan to meet all your retirement needs.